How to Evaluate Your Health Insurance Plan-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

Here’s a draft of an article on evaluating health insurance plans, exceeding 1500 words. Remember to replace the bracketed information with actual data and specifics relevant to Waukesha Health Insurance and its offerings. I cannot create functional hyperlinks; you’ll need to manually add those to the final version. Also, I’ve included several mentions of www.waukeshahealthinsurance.com, but remember to actually link them when publishing.

How to Evaluate Your Health Insurance Plan

Choosing the right health insurance plan can feel overwhelming. With a myriad of options, varying coverage levels, and confusing jargon, it’s easy to feel lost in the process. However, understanding the key factors and asking the right questions can significantly simplify your decision-making. This comprehensive guide will walk you through the essential steps to evaluate your health insurance plan and ensure you’re getting the best coverage for your needs and budget. For residents of Waukesha County, Wisconsin, exploring options through www.waukeshahealthinsurance.com is a great starting point.

1. Understanding Your Needs:

Before diving into plan details, take time to assess your individual healthcare needs. Consider the following:

Your Health History: Do you have pre-existing conditions? Are you currently taking prescription medications? Do you anticipate needing significant medical care in the near future? Understanding your health history helps you identify essential coverage elements.

Your Lifestyle: Are you generally healthy and only require routine check-ups? Or do you participate in high-risk activities that might increase your likelihood of injury or illness? Your lifestyle influences the level of coverage you require.

Your Family’s Health: If you have a family, consider their health needs as well. Are there any chronic conditions within your family that might require extensive medical care? Family planning also plays a significant role in choosing a plan with adequate coverage for maternity care, pediatric services, and other family-related needs.

Your Budget: Health insurance premiums, deductibles, co-pays, and out-of-pocket maximums all impact your budget. Determine how much you can comfortably afford to spend on health insurance each month. Using online tools or consulting with a financial advisor can help you determine a realistic budget. www.waukeshahealthinsurance.com may offer resources to help you budget effectively.

2. Deciphering the Jargon:

Health insurance policies are filled with technical terms. Understanding these terms is crucial for making informed decisions. Here are some key terms to familiarize yourself with:

Premium: The monthly payment you make to maintain your health insurance coverage.

Deductible: The amount you must pay out-of-pocket for healthcare services before your insurance coverage kicks in.

Copay: A fixed amount you pay for a doctor’s visit or other covered services.

Coinsurance: The percentage of costs you share with your insurance company after you’ve met your deductible.

Out-of-Pocket Maximum: The maximum amount you will pay out-of-pocket for covered services in a given year. Once you reach this limit, your insurance company covers 100% of the remaining costs.

Network: The group of doctors, hospitals, and other healthcare providers that your insurance plan covers. Using in-network providers generally results in lower costs.

Formulary: A list of prescription drugs covered by your insurance plan. Your plan may require you to use generic medications or obtain prior authorization for certain brand-name drugs.

3. Comparing Plans:

Once you understand your needs and the key terminology, it’s time to compare different health insurance plans. Consider the following factors:

Coverage Levels: Plans typically offer different levels of coverage, such as Bronze, Silver, Gold, and Platinum. Bronze plans have lower premiums but higher out-of-pocket costs, while Platinum plans have higher premiums but lower out-of-pocket costs. The best level for you depends on your individual circumstances and risk tolerance.

Network Size: A larger network offers more choices when selecting doctors and hospitals. However, larger networks may also come with higher premiums.

Prescription Drug Coverage: If you take prescription medications, carefully review the formulary to ensure your medications are covered. Pay attention to any prior authorization requirements.

Maternity Care: If you’re planning a family, ensure your plan covers maternity care, including prenatal visits, delivery, and postpartum care.

Mental Health Coverage: Many plans now offer robust mental health coverage, including therapy and medication. Review the details of mental health benefits to ensure they meet your needs.

Customer Service: Consider the reputation of the insurance company’s customer service. Read reviews and check ratings to gauge their responsiveness and helpfulness.

4. Utilizing Resources:

Several resources can assist you in evaluating health insurance plans:

Healthcare.gov: If you’re eligible for subsidies through the Affordable Care Act (ACA), you can use Healthcare.gov to compare plans and enroll.

Your Employer: If your employer offers health insurance, review the available plans and their details. Your employer’s human resources department can provide assistance.

Independent Insurance Agents: Independent agents can help you compare plans from multiple insurance companies, ensuring you find the best option for your needs. www.waukeshahealthinsurance.com might connect you with local agents.

Online Comparison Tools: Many websites offer tools to compare health insurance plans based on your specific needs and location.

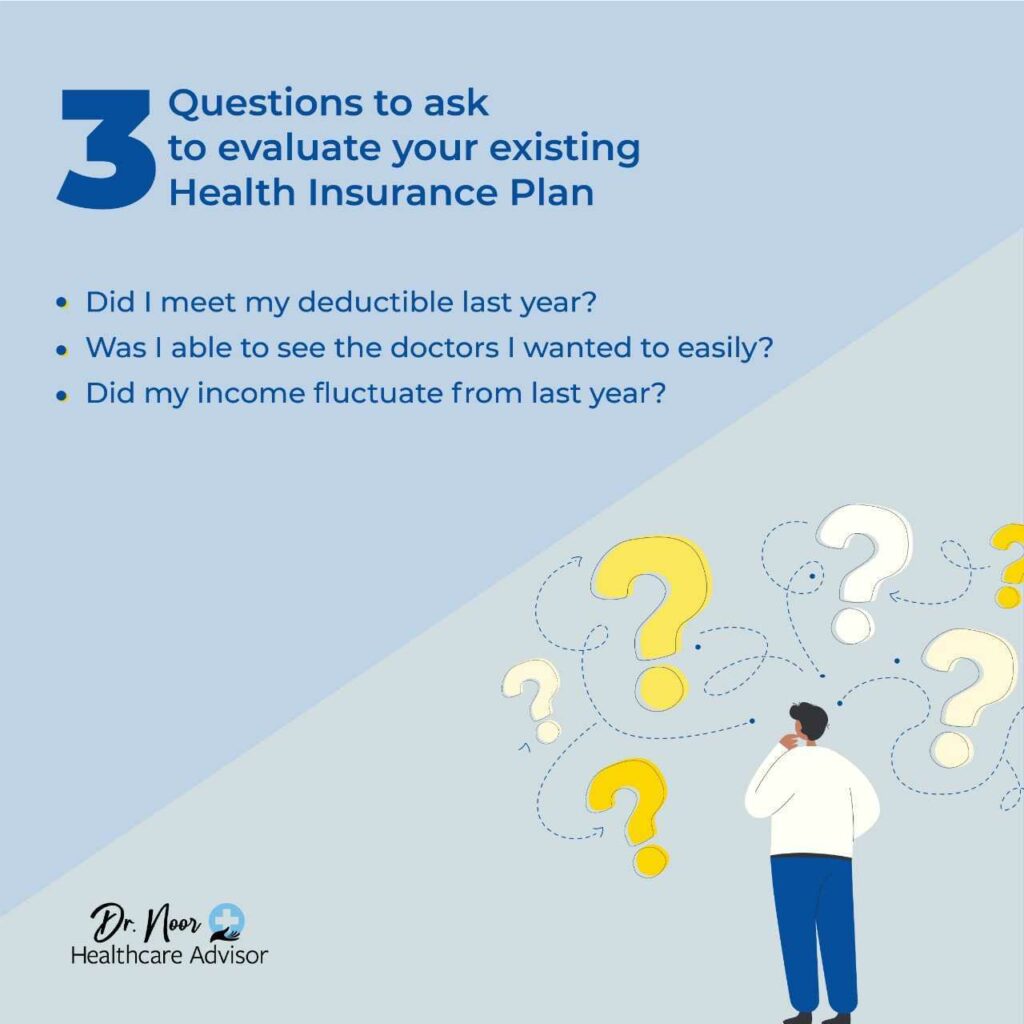

5. Reviewing Your Plan Regularly:

Your healthcare needs may change over time. It’s essential to review your health insurance plan annually to ensure it continues to meet your needs. Life events such as marriage, childbirth, or changes in employment can significantly impact your healthcare requirements. www.waukeshahealthinsurance.com may offer tools to track changes and assist with plan updates.

Choosing the right health insurance plan is a crucial decision. By carefully considering your needs, understanding the terminology, comparing plans, and utilizing available resources, you can make an informed choice that protects your health and financial well-being. Remember to consult www.waukeshahealthinsurance.com for local options and assistance in Waukesha County. This website [insert description of services offered on the website, e.g., plan comparison tools, agent contact information, educational resources]. Don’t hesitate to contact a qualified insurance professional for personalized guidance. They can help you navigate the complexities of health insurance and select the plan that best suits your unique circumstances. Taking the time to thoroughly evaluate your options will pay off in the long run, ensuring you have the peace of mind that comes with comprehensive and affordable health coverage.