Health Insurance Savings Accounts: How to Use Them Wisely-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

High deductibles, unexpected medical bills, and the ever-increasing price of healthcare services leave many individuals and families struggling to manage their health expenses. However, a powerful tool exists to help mitigate these challenges: the Health Savings Account (HSA). Understanding how to effectively utilize an HSA can significantly improve your financial health and provide peace of mind when facing unexpected medical needs.

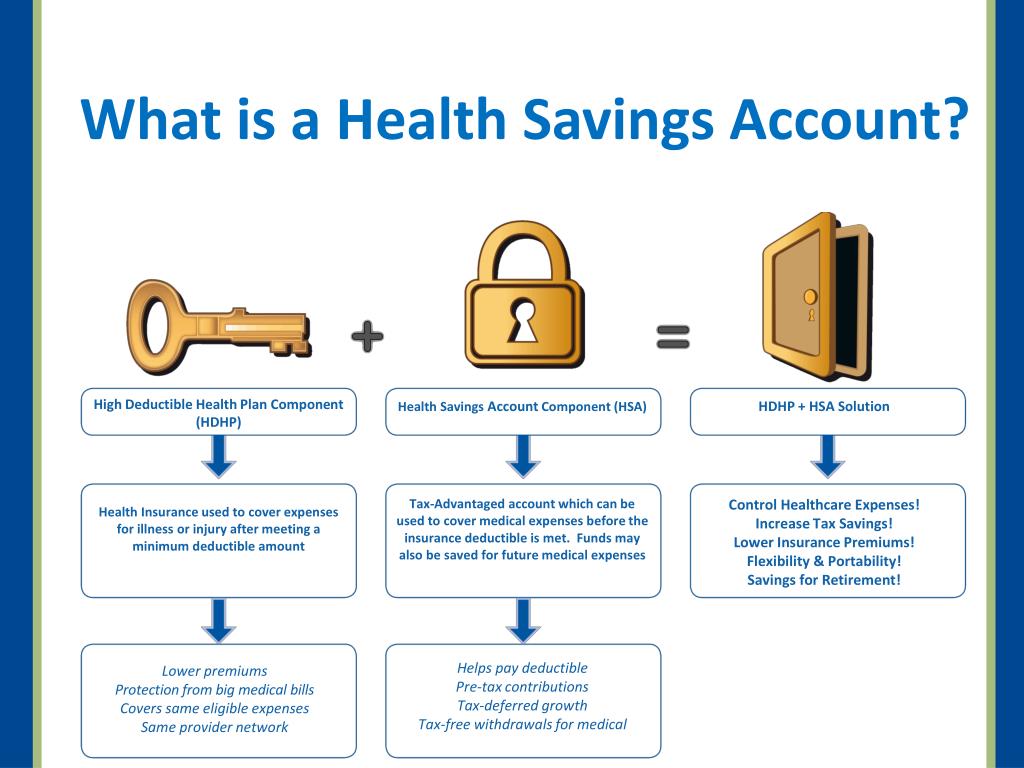

What is a Health Savings Account (HSA)?

An HSA is a tax-advantaged savings account specifically designed to pay for qualified medical expenses. It’s paired with a high-deductible health plan (HDHP), meaning you’ll pay more out-of-pocket before your insurance coverage kicks in. The key benefit is the triple tax advantage: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. This makes HSAs a powerful tool for long-term healthcare savings.

Eligibility Requirements:

To be eligible for an HSA, you must be enrolled in a qualified HDHP. This means your health insurance plan must meet specific requirements regarding its deductible and out-of-pocket maximums. Additionally, you cannot be enrolled in other health coverage, such as Medicare or Medicaid, and you cannot be claimed as a dependent on someone else’s tax return. Learn more about HDHP eligibility and HSA requirements by visiting our website at www.waukeshahealthinsurance.com.

The Triple Tax Advantage: Maximizing Your HSA’s Potential

The triple tax advantage of an HSA is its most compelling feature:

Tax-Deductible Contributions: Contributions made to your HSA are typically deductible from your taxable income, reducing your overall tax burden. The contribution limits are adjusted annually by the IRS, so it’s crucial to stay updated on the current limits. Check the current IRS contribution limits for HSAs on our website: www.waukeshahealthinsurance.com.

Tax-Free Growth: The money in your HSA grows tax-free. This means your investment earnings aren’t subject to income tax, allowing your savings to accumulate faster than in a traditional savings account. You can invest your HSA funds in various options, including stocks, bonds, and mutual funds, depending on your HSA provider. Explore different investment options for your HSA at www.waukeshahealthinsurance.com.

Tax-Free Withdrawals for Qualified Medical Expenses: When you withdraw money from your HSA to pay for qualified medical expenses, these withdrawals are tax-free. This is a significant advantage compared to other savings accounts where withdrawals are typically taxed as income.

Qualified Medical Expenses:

A wide range of expenses qualify for HSA reimbursement. These include:

- Doctor visits: This encompasses routine checkups, specialist appointments, and emergency room visits.

- Prescription drugs: Both brand-name and generic medications are eligible.

- Hospital stays: Costs associated with inpatient hospital care, including surgery and procedures.

- Dental and vision care: While some plans may cover these expenses, they are generally considered qualified medical expenses for HSA purposes.

- Over-the-counter medications: Certain OTC medications, with a doctor’s prescription, can be reimbursed.

- Mental health services: Therapy, counseling, and psychiatric care are all qualified expenses.

- Durable medical equipment: Items such as wheelchairs, walkers, and CPAP machines.

It’s crucial to keep detailed records of your medical expenses and receipts to substantiate your withdrawals. The IRS provides a comprehensive list of qualified medical expenses, which you can find online. We can help you understand which expenses qualify; contact us at www.waukeshahealthinsurance.com.

Strategic HSA Utilization: A Long-Term Perspective

Many people view their HSA as simply a way to pay for current medical expenses. However, a more strategic approach involves considering it as a long-term savings vehicle. The tax advantages make it an ideal tool for saving for future healthcare costs, such as retirement healthcare expenses, which can be substantial.

Strategies for Wise HSA Usage:

Maximize Contributions: Contribute the maximum allowable amount each year. This will significantly boost your savings and minimize your taxable income.

Invest Wisely: If your HSA provider allows investments, consider diversifying your portfolio to maximize returns. Consult with a financial advisor to develop a suitable investment strategy.

Track Expenses: Keep meticulous records of all your medical expenses and receipts. This will ensure you can easily claim reimbursements and avoid any potential tax issues.

Plan for Future Healthcare Costs: Consider your future healthcare needs and plan accordingly. The money in your HSA can grow tax-free, making it a valuable asset for retirement healthcare expenses.

Use for Non-Medical Expenses in Retirement: While it’s best to use your HSA for medical expenses, after age 65, you can withdraw funds for non-qualified expenses. However, these withdrawals will be subject to income tax and a 20% penalty. This option should be considered only as a last resort.

Consider a Family HSA: If you have a family, a family HSA can be beneficial. You can contribute more, and the funds can be used to cover the medical expenses of all family members covered under the HDHP.

Choosing the Right HSA Provider:

Selecting the right HSA provider is crucial. Consider factors such as:

- Investment options: Does the provider offer a range of investment options to suit your risk tolerance?

- Fees: Are there any account maintenance fees or transaction fees?

- Customer service: Is the provider responsive and helpful?

- Ease of use: Is the online platform user-friendly and easy to navigate?

Compare different HSA providers and find the best option for your needs at www.waukeshahealthinsurance.com. We can help you navigate the complexities of choosing an HSA provider and finding the right plan for your specific needs.

Conclusion:

HSAs are a powerful tool for managing healthcare costs and building long-term financial security. By understanding the rules, maximizing contributions, investing wisely, and planning for the future, you can harness the triple tax advantage of an HSA to significantly improve your financial well-being. Don’t hesitate to seek professional advice from a financial advisor or healthcare specialist to ensure you’re making the most of this valuable resource. Contact us today at www.waukeshahealthinsurance.com to learn more about HSAs and how they can benefit you.