Health Insurance for Injuries: What You Need to Know-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

One minute you’re enjoying a hike, the next you’ve twisted your ankle. Or perhaps a sudden slip on the ice sends you to the emergency room. Unexpected injuries can be painful, disruptive, and expensive. This is where health insurance plays a crucial role, offering a financial safety net when you least expect to need it. Understanding your health insurance coverage for injuries is vital to navigating the healthcare system effectively and avoiding overwhelming medical bills. This article will explore the key aspects of health insurance and injury treatment, helping you understand what to expect and how to best protect yourself.

Types of Health Insurance Plans and Injury Coverage:

The first step in understanding your injury coverage is knowing the type of health insurance plan you have. Several common plans exist, each with varying levels of coverage and out-of-pocket costs:

HMO (Health Maintenance Organization): HMO plans typically require you to choose a primary care physician (PCP) within their network. Referrals from your PCP are usually needed to see specialists, including those treating injuries. HMOs generally offer lower premiums but may have stricter limitations on accessing out-of-network care.

PPO (Preferred Provider Organization): PPO plans offer more flexibility. You can see specialists without a referral and often have the option of seeing out-of-network providers, although you’ll typically pay a higher cost-share. PPOs usually have higher premiums than HMOs but offer greater choice.

EPO (Exclusive Provider Organization): Similar to HMOs, EPOs require you to stay within the network. However, unlike HMOs, EPOs typically don’t require a referral to see specialists.

POS (Point of Service): POS plans combine elements of HMOs and PPOs. They usually require a PCP, but offer the option of seeing out-of-network providers at a higher cost.

Medicare and Medicaid: These government-sponsored programs provide health insurance to seniors (Medicare) and low-income individuals (Medicaid). Coverage for injuries varies depending on the specific plan and state.

No matter your plan type, understanding your policy’s specifics is crucial. Your policy documents will outline your:

- Deductible: The amount you must pay out-of-pocket before your insurance coverage begins.

- Copay: A fixed amount you pay for each doctor’s visit or service.

- Coinsurance: Your share of the costs of covered healthcare services, calculated as a percentage (e.g., 20%) after you’ve met your deductible.

- Out-of-pocket maximum: The most you’ll pay out-of-pocket in a year. Once you reach this limit, your insurance covers 100% of covered services.

Navigating Injury Claims:

When an injury occurs, prompt action is key. Here’s a step-by-step guide to navigating the claims process:

Seek Immediate Medical Attention: If your injury requires immediate care, go to the nearest emergency room or urgent care facility. Document everything, including the date, time, location of the incident, and the nature of your injury.

Notify Your Insurance Provider: Contact your insurance company as soon as possible to report the injury and begin the claims process. They will provide you with the necessary forms and instructions.

Gather Necessary Documentation: Collect all relevant medical bills, receipts, and any other documentation related to your injury and treatment. This will help expedite the claims process.

Understand Your Policy’s Coverage: Review your policy carefully to understand what services are covered and what your financial responsibility is. Don’t hesitate to contact your insurance provider if you have any questions.

Follow Your Doctor’s Orders: Adhering to your doctor’s treatment plan is crucial for a successful recovery and for ensuring your insurance claim is processed smoothly.

Specific Injury Coverage Considerations:

Different injuries may have different coverage implications. For example:

Emergency Room Visits: Most health insurance plans cover emergency room visits, but you’ll still likely have to pay your deductible and coinsurance.

Surgery: Surgical procedures are typically covered, but the extent of coverage depends on the necessity of the surgery and your specific plan.

Physical Therapy and Rehabilitation: Many plans cover physical therapy and rehabilitation services, but pre-authorization may be required.

Prescription Medications: Coverage for prescription medications varies depending on your plan and the specific medication.

Long-Term Care: Long-term care, such as extended rehabilitation or nursing home stays, is often not fully covered by standard health insurance plans. Supplemental long-term care insurance may be necessary.

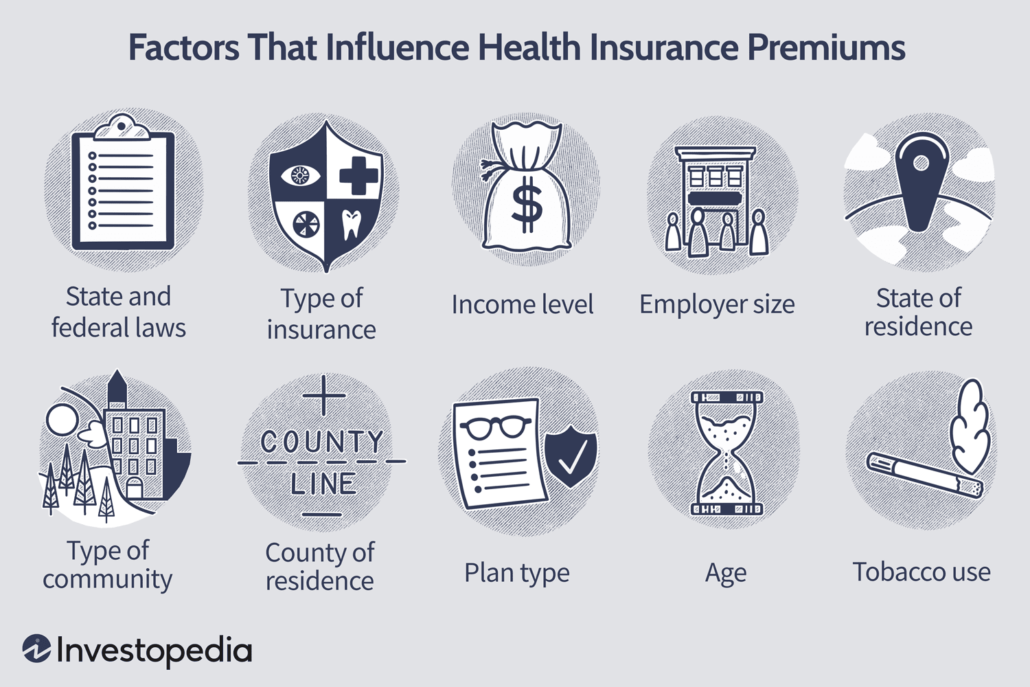

Finding the Right Health Insurance:

Choosing the right health insurance plan can be challenging. Consider factors such as your budget, health needs, and preferred healthcare providers. Comparing plans and understanding the details of each policy is essential. For assistance finding a plan that suits your needs, consider consulting with an insurance broker or using online comparison tools. If you live in the Waukesha area, you can explore your options with a local provider such as Waukesha Health Insurance. They can help you navigate the complexities of health insurance and find a plan that meets your specific requirements. Click here to learn more.

Beyond Basic Coverage: Supplemental Insurance

While comprehensive health insurance is essential, supplemental insurance can further protect you from unexpected medical costs. Consider these options:

Accident Insurance: This type of insurance provides coverage for injuries resulting from accidents, regardless of whether they’re covered by your health insurance.

Critical Illness Insurance: This insurance pays a lump sum if you’re diagnosed with a serious illness, such as cancer or a heart attack, which can help cover treatment costs and other expenses.

Disability Insurance: If an injury prevents you from working, disability insurance can replace a portion of your lost income.

Protecting Yourself:

Beyond health insurance, proactive steps can minimize your risk of injury and reduce the financial burden if an injury does occur. These include:

Maintaining a Healthy Lifestyle: Regular exercise, a balanced diet, and adequate sleep can improve your overall health and reduce your risk of injury.

Practicing Safety Precautions: Wearing seatbelts, using safety equipment at work, and taking precautions to avoid falls can significantly reduce your risk of accidents.

Regular Health Checkups: Regular checkups with your doctor can help identify and address potential health issues before they become serious.

In conclusion, health insurance plays a vital role in managing the financial burden associated with injuries. Understanding your policy, knowing your rights, and taking proactive steps to protect yourself are crucial for navigating the healthcare system effectively and ensuring you receive the care you need without facing insurmountable financial challenges. Remember to consult with your insurance provider or a qualified insurance broker to ensure you have the right coverage for your individual needs. Don’t hesitate to explore your options and find the best health insurance plan for you and your family. For residents of Waukesha, Wisconsin, exploring options with Waukesha Health Insurance is a great starting point. Visit their website today to learn more about your coverage options.