The Best Health Insurance Plans for People with Disabilities-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

Here’s a draft of a 1500-word article about the best health insurance plans for people with disabilities. Remember to replace the bracketed information with actual data and statistics relevant to your target audience and location. Also, ensure all legal and ethical considerations are met before publishing. I cannot create links; you will need to manually add the hyperlinks to www.waukeshahealthinsurance.com where indicated.

The Best Health Insurance Plans for People with Disabilities

Navigating the world of health insurance can be challenging for anyone, but it’s particularly complex for individuals with disabilities. The high cost of medical care, specialized equipment, and ongoing therapies often necessitates comprehensive coverage that goes beyond standard plans. Finding the right health insurance plan is crucial for maintaining health, well-being, and financial stability. This article explores key considerations when choosing a health insurance plan and highlights options available to people with disabilities.

Understanding Your Needs:

Before diving into specific plans, it’s vital to understand your unique healthcare needs. Consider the following:

Type and Severity of Disability: The nature and severity of your disability significantly impact your healthcare requirements. Conditions requiring frequent medical visits, specialized equipment (wheelchairs, prosthetics), or ongoing therapies will demand a plan with robust coverage.

Current Medications and Treatments: List all current medications, therapies, and medical equipment you rely on. This list will help you determine the necessary coverage levels for prescription drugs, durable medical equipment (DME), and therapies.

Expected Future Healthcare Needs: Consider potential future needs based on your condition’s progression. A plan that adequately addresses current needs might not suffice in the long term. Think about potential hospitalizations, rehabilitation, or long-term care.

Financial Resources: Assess your budget and determine the premium you can comfortably afford. Consider whether you qualify for government assistance programs like Medicaid or Medicare.

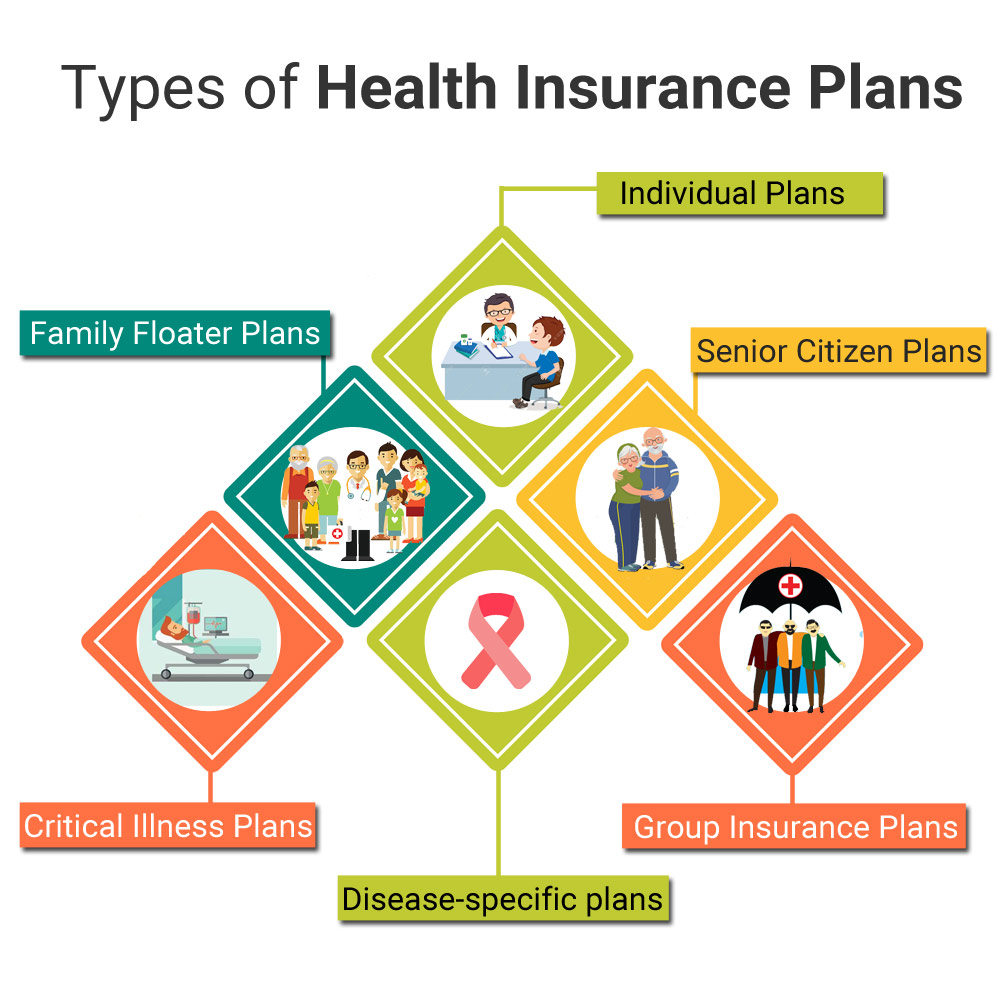

Types of Health Insurance Plans:

Several health insurance plans cater to the needs of individuals with disabilities. Understanding the differences is essential for making an informed decision:

Medicare: [Link to relevant section on www.waukeshahealthinsurance.com] Medicare is a federal health insurance program primarily for individuals aged 65 and older and certain younger people with disabilities. It typically offers comprehensive coverage, including hospitalization, doctor visits, and some prescription drugs. However, it may not cover all specialized services or equipment.

Medicaid: [Link to relevant section on www.waukeshahealthinsurance.com] Medicaid is a joint federal and state program providing healthcare coverage to low-income individuals and families, including many people with disabilities. Eligibility criteria vary by state. Medicaid often covers a broader range of services than Medicare, including long-term care.

Affordable Care Act (ACA) Marketplace Plans: [Link to relevant section on www.waukeshahealthinsurance.com] The ACA marketplaces offer a range of plans with varying levels of coverage. These plans are subject to regulations that prohibit discrimination based on pre-existing conditions, ensuring access to coverage for individuals with disabilities. However, premiums and out-of-pocket costs can vary significantly. It is important to carefully compare plans based on your specific needs and budget.

Employer-Sponsored Insurance: [Link to relevant section on www.waukeshahealthinsurance.com] If you are employed, your employer may offer health insurance. Review the plan’s coverage details carefully to determine if it adequately addresses your healthcare needs. Some employer-sponsored plans offer more comprehensive coverage than others.

Private Health Insurance Plans: [Link to relevant section on www.waukeshahealthinsurance.com] Several private insurers offer comprehensive health insurance plans designed for individuals with disabilities. These plans may offer customized coverage options to meet specific needs. However, it’s crucial to compare plans and carefully review the policy documents before enrolling.

Key Considerations for People with Disabilities:

Essential Health Benefits (EHBs): The ACA mandates that all marketplace plans cover ten essential health benefits, including hospitalization, maternity and newborn care, mental health services, and prescription drugs. However, the extent of coverage can vary between plans.

Prescription Drug Coverage: The cost of prescription drugs can be substantial, especially for individuals with chronic conditions. Choose a plan with a comprehensive formulary and favorable cost-sharing arrangements.

Durable Medical Equipment (DME): Many disabilities require specialized equipment like wheelchairs, oxygen tanks, or prosthetics. Ensure your plan covers DME and has reasonable coverage limits.

Rehabilitation Services: Physical therapy, occupational therapy, and speech therapy are often essential for individuals with disabilities. Choose a plan that covers these services adequately.

Mental Health Services: Mental health is crucial for overall well-being. Select a plan with comprehensive coverage for mental health services, including therapy and medication.

Long-Term Care: Long-term care can be expensive. Consider whether your plan offers coverage for long-term care services or if you need supplemental insurance.

Network Providers: Choose a plan with a network of providers that includes specialists familiar with your specific disability. This can ensure you receive timely and appropriate care.

Appeals Process: Understand the plan’s appeals process in case of denied claims. A robust appeals process can be crucial if your claim is denied for a necessary service or equipment.

Finding the Right Plan:

Finding the right health insurance plan requires careful research and comparison. Utilize online resources, consult with healthcare professionals, and consider seeking assistance from disability advocacy organizations. [Link to www.waukeshahealthinsurance.com for plan comparison tools] can help you compare plans based on your specific needs and budget.

Advocating for Your Needs:

Don’t hesitate to advocate for your healthcare needs. Clearly communicate your requirements to your insurance provider and healthcare professionals. If you encounter challenges accessing necessary services or equipment, explore your options for appealing decisions or seeking assistance from disability advocacy groups.

Conclusion:

Choosing the right health insurance plan is a crucial step in managing your health and well-being. By carefully considering your individual needs, understanding the different plan options, and actively advocating for your rights, you can secure the coverage you need to live a healthy and fulfilling life. Remember to consult with a qualified insurance professional or disability advocate to ensure you make the best choice for your circumstances. [Link to contact information on www.waukeshahealthinsurance.com] for personalized assistance.