What to Know About Health Insurance Coverage for Maternity Care-www.waukeshahealthinsurance.com

What to Know About Health Insurance Coverage for Maternity Care

Planning for a baby is an exciting time, filled with anticipation and dreams for the future. However, amidst the joy, the financial aspects of pregnancy and childbirth can be a significant source of stress. Understanding your health insurance coverage for maternity care is crucial to navigating this journey with greater peace of mind. This comprehensive guide will delve into the intricacies of maternity benefits, helping you understand what to expect and how to best prepare.

Understanding Your Health Insurance Plan:

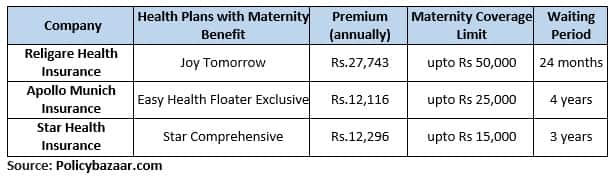

The first step in planning for maternity care is thoroughly reviewing your health insurance policy. Not all plans are created equal, and the level of coverage for maternity care can vary significantly. Key factors to consider include:

Type of Plan: Different types of health insurance plans, such as HMOs, PPOs, and EPOs, offer varying levels of flexibility in choosing your healthcare providers. Understanding your plan’s network of providers is crucial, as out-of-network care can lead to significantly higher costs. Learn more about the different types of plans and how they impact your maternity care costs by visiting our website. [www.waukeshahealthinsurance.com]

Pre-existing Conditions: The Affordable Care Act (ACA) prohibits health insurance companies from denying coverage or charging higher premiums based on pre-existing conditions, including pregnancy. However, it’s essential to understand your plan’s specific rules regarding pre-existing conditions and how they might affect your maternity care coverage.

Deductible, Copay, and Coinsurance: These terms are fundamental to understanding your out-of-pocket expenses. Your deductible is the amount you must pay out-of-pocket before your insurance coverage kicks in. Your copay is a fixed amount you pay for each doctor’s visit, while coinsurance is the percentage of the cost you pay after meeting your deductible. Understanding these cost-sharing components is critical for budgeting for maternity care. Find helpful tools and resources on our site to calculate your estimated costs. [www.waukeshahealthinsurance.com]

Maximum Out-of-Pocket Limit: This is the most you’ll pay out-of-pocket for covered services in a plan year. Once you reach this limit, your insurance will cover 100% of the remaining costs. Knowing your maximum out-of-pocket limit can help you budget effectively.

Covered Services: Your policy should clearly outline the specific services covered under your maternity benefits. This typically includes prenatal care, labor and delivery, postpartum care, and newborn care. However, some plans may have limitations on the types of facilities or providers covered. Check your policy details or contact your insurance provider to confirm the specific services covered under your plan. [www.waukeshahealthinsurance.com]

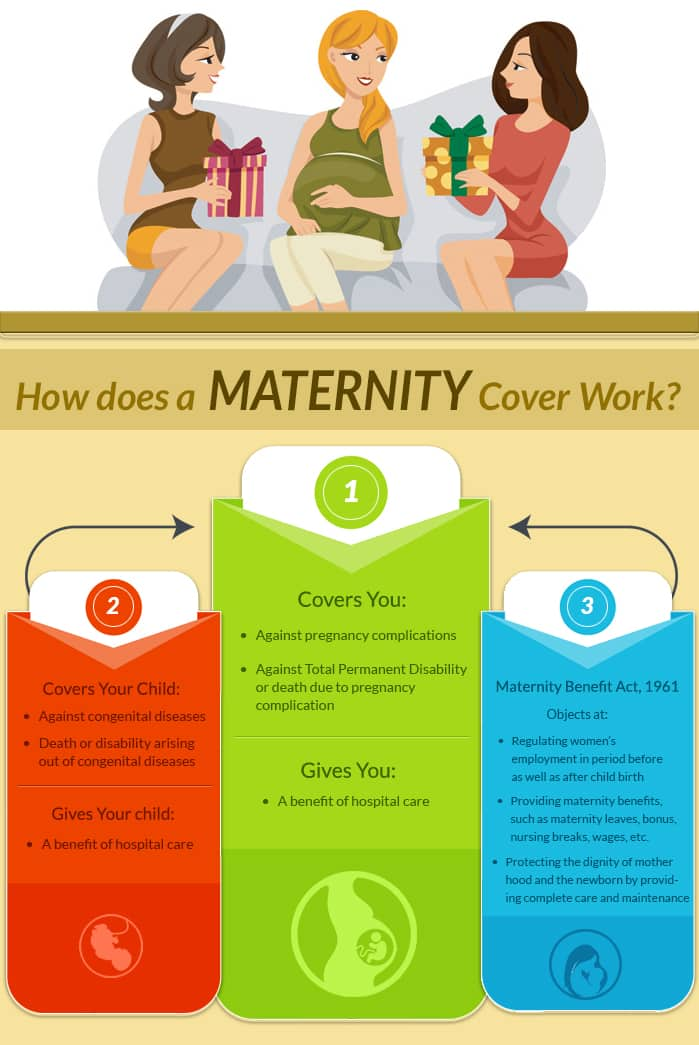

Essential Maternity Care Services and Coverage:

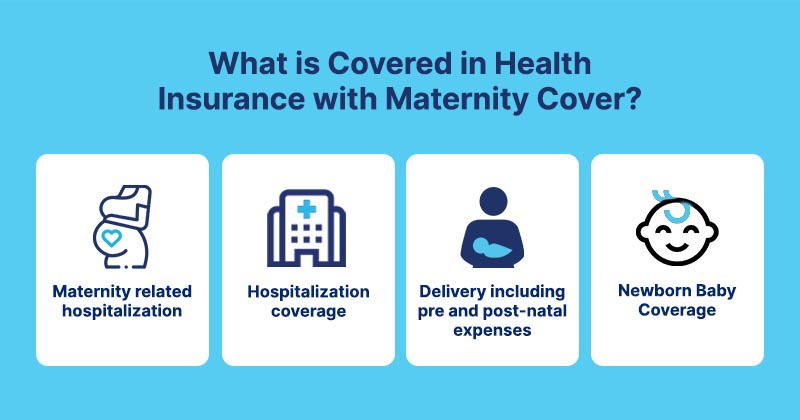

Maternity care encompasses a wide range of services, and understanding which are typically covered is crucial. These include:

Prenatal Care: This includes regular checkups with your obstetrician or midwife throughout your pregnancy, including ultrasounds, blood tests, and other diagnostic procedures. Most plans cover these essential prenatal visits.

Labor and Delivery: This covers the costs associated with labor, delivery, and any necessary medical interventions during childbirth. This can include hospital stays, anesthesia, and medications.

Postpartum Care: This includes checkups for both mother and baby after delivery. Postpartum care is vital for monitoring the mother’s recovery and the baby’s health.

Newborn Care: This covers the newborn’s initial medical examinations and any necessary treatment during their stay in the hospital. This often includes vaccinations and screening tests.

Lactation Consultation: Many plans cover consultations with lactation consultants to help mothers with breastfeeding.

Navigating Potential Challenges:

While most health insurance plans cover maternity care, there are potential challenges to be aware of:

Out-of-Network Providers: Choosing a provider outside your plan’s network can lead to significantly higher costs. Always verify that your chosen doctor and hospital are in-network.

Unexpected Complications: Unforeseen complications during pregnancy or childbirth can lead to unexpected medical bills. Understanding your plan’s coverage for complications and potential out-of-pocket expenses is essential.

Limited Coverage for Certain Services: Some plans may have limitations on the types of services covered, such as certain types of childbirth or specific fertility treatments. Carefully review your policy to understand any limitations.

Appeal Process: If your claim is denied, understand your plan’s appeal process. You have the right to appeal a denial if you believe the denial is incorrect.

Planning and Preparation:

To minimize financial stress during pregnancy and childbirth, consider these steps:

Review Your Policy Thoroughly: Carefully review your policy to understand your coverage, benefits, and limitations.

Choose In-Network Providers: Select your obstetrician, midwife, and hospital from your plan’s network to avoid higher out-of-pocket costs.

Create a Budget: Develop a budget that accounts for your expected maternity care expenses, including deductibles, copays, and coinsurance.

Explore Financial Assistance Options: If you anticipate significant out-of-pocket expenses, explore financial assistance options, such as payment plans or assistance programs.

Contact Your Insurance Provider: Don’t hesitate to contact your insurance provider with any questions or concerns regarding your maternity care coverage. Our website offers resources and contact information to help you connect with your insurance provider or find answers to your questions. [www.waukeshahealthinsurance.com]

Conclusion:

Navigating health insurance coverage for maternity care can seem daunting, but with careful planning and a thorough understanding of your policy, you can approach this exciting journey with greater confidence. Remember to review your policy details, choose in-network providers, and create a budget to effectively manage the financial aspects of pregnancy and childbirth. By taking proactive steps, you can focus on enjoying this special time in your life without unnecessary financial stress. For further assistance and resources, visit our website today. [www.waukeshahealthinsurance.com]