Health Insurance for Travelers: What to Know Before You Go-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

However, the excitement can quickly fade if you encounter a medical emergency far from home. This is where comprehensive travel health insurance becomes crucial. It’s not just about peace of mind; it’s about protecting your financial well-being and ensuring access to quality healthcare wherever your adventures may take you. Before you pack your bags, understanding the nuances of travel health insurance is paramount. This article will guide you through the essential aspects to consider, helping you make informed decisions to safeguard your health and finances while traveling.

Why Travel Health Insurance is Essential

Your existing health insurance policy, whether it’s through your employer or a private provider, likely won’t offer adequate coverage abroad. Many policies have limited or no coverage for medical expenses incurred outside your home country. Even if your policy does offer some international coverage, it’s often insufficient to cover the high costs of emergency medical treatment, hospitalization, or medical evacuation in foreign countries. These costs can quickly escalate into tens of thousands of dollars, potentially leaving you with a crippling financial burden.

Furthermore, navigating foreign healthcare systems can be daunting. Language barriers, unfamiliar procedures, and different medical standards can add to the stress of an already difficult situation. Travel health insurance provides access to assistance services that can help you find English-speaking doctors, negotiate with hospitals, and even arrange for medical evacuation if necessary.

Types of Travel Health Insurance

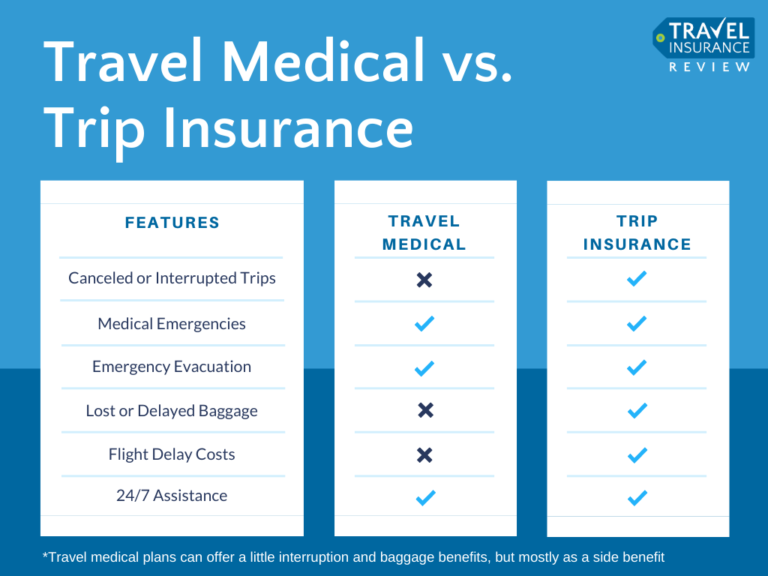

Travel health insurance plans vary widely in their coverage and cost. Understanding the different types available is crucial for selecting the right plan for your specific needs and trip length. Generally, you’ll find these categories:

Standard Travel Insurance: This is a basic level of coverage that typically includes medical expenses, emergency medical evacuation, and repatriation of remains. It may also include coverage for trip cancellations or interruptions due to unforeseen circumstances.

Comprehensive Travel Insurance: This offers broader coverage than standard plans, often including additional benefits such as lost luggage, personal liability, and 24/7 emergency assistance services. It’s a good option for longer trips or those involving higher-risk activities.

Backpacker/Adventure Travel Insurance: Designed for travelers engaging in adventurous activities like hiking, skiing, or scuba diving, these plans often cover injuries related to these activities, which might be excluded from standard policies.

Luxury Travel Insurance: For high-net-worth individuals, luxury travel insurance provides enhanced coverage and concierge services, including access to private medical facilities and personalized assistance.

Key Factors to Consider When Choosing a Plan

Selecting the right travel health insurance plan requires careful consideration of several factors:

Destination: The cost of healthcare varies significantly across countries. Travel to countries with expensive healthcare systems will necessitate a plan with higher coverage limits.

Trip Length: Longer trips require more extensive coverage. Consider a plan that aligns with the duration of your stay.

Activities: If you plan on engaging in high-risk activities, ensure your policy covers those activities. Many standard plans exclude coverage for extreme sports or adventure activities.

Pre-existing Conditions: Some plans may exclude coverage for pre-existing medical conditions. If you have any pre-existing conditions, it’s crucial to disclose them to the insurer and ensure they are covered under the policy. For more information on pre-existing condition coverage, visit our website at www.waukeshahealthinsurance.com.

Coverage Limits: Pay close attention to the policy’s coverage limits for medical expenses, emergency medical evacuation, and other benefits. Choose a plan with limits that are sufficient to cover potential costs.

Emergency Assistance Services: Look for plans that offer 24/7 access to emergency assistance services. These services can be invaluable in navigating foreign healthcare systems and coordinating medical care.

Cost: Compare the cost of different plans with similar coverage levels to find the best value for your money. Don’t solely focus on the price; consider the comprehensive nature of the coverage offered.

What to Include in Your Travel Insurance Policy

A comprehensive travel insurance policy should ideally include the following:

Medical Expenses: Coverage for doctor visits, hospital stays, surgeries, medications, and other medical treatments.

Emergency Medical Evacuation: Coverage for transportation to the nearest appropriate medical facility, including air ambulance if necessary.

Repatriation of Remains: Coverage for transporting your body back to your home country in the event of death.

Trip Interruption/Cancellation: Coverage for unforeseen events that may force you to cancel or interrupt your trip.

Lost or Stolen Belongings: Coverage for lost or stolen luggage and personal belongings.

Personal Liability: Coverage for legal expenses if you are held liable for an accident or injury to another person.

24/7 Emergency Assistance: Access to a dedicated assistance team available around the clock to provide support and guidance.

Buying Travel Insurance: Tips and Recommendations

Purchase insurance early: Don’t wait until the last minute to purchase travel insurance. Many policies require a waiting period before coverage begins.

Read the policy carefully: Before purchasing a policy, carefully review the terms and conditions to ensure you understand the coverage provided.

Compare different plans: Compare several plans from different insurers to find the best coverage at the most competitive price. Use online comparison tools or consult with an insurance broker for assistance at www.waukeshahealthinsurance.com.

Keep your policy information readily accessible: Make copies of your policy documents and keep them in a safe place, both physically and digitally. Also, store the contact information for your insurer’s emergency assistance services.

Notify your insurer of any changes: If your travel plans change, notify your insurer immediately. This is especially important if you extend your trip or change your destination.

Beyond the Basics: Adding Extra Layers of Protection

Consider these additional layers of protection to further enhance your travel safety:

Vaccinations and preventative measures: Consult your doctor about recommended vaccinations and preventative measures for your destination.

Travel medical kit: Pack a well-stocked travel medical kit containing essential medications, bandages, antiseptic wipes, and pain relievers.

Copies of important documents: Make copies of your passport, visa, driver’s license, and other important documents and store them separately from the originals.

Emergency contact information: Share your itinerary and emergency contact information with family and friends.

Conclusion

Traveling should be an enjoyable and enriching experience. However, unforeseen medical emergencies can quickly turn a dream vacation into a financial nightmare. Investing in comprehensive travel health insurance is a smart and responsible decision that protects your health, your finances, and your peace of mind. By understanding the different types of plans available, carefully considering your needs, and choosing a policy that offers adequate coverage, you can travel with confidence, knowing that you’re prepared for whatever may come your way. Remember to always consult with a qualified insurance professional for personalized advice and to ensure you have the right coverage for your specific travel plans. For further assistance and to explore your options, contact us at www.waukeshahealthinsurance.com. Safe travels!