Health Insurance: A Lifeline for Preventative Care-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

Unexpected illnesses and injuries can quickly lead to crippling debt, forcing people to make difficult choices between their health and financial stability. This is where health insurance steps in, acting as a crucial safety net and, increasingly, a vital tool for promoting preventative care. While the primary function of health insurance is to cover the costs of treatment for illness and injury, its role in facilitating preventative care is equally, if not more, important in the long run. Explore your options for comprehensive health insurance coverage in Waukesha County by visiting www.waukeshahealthinsurance.com.

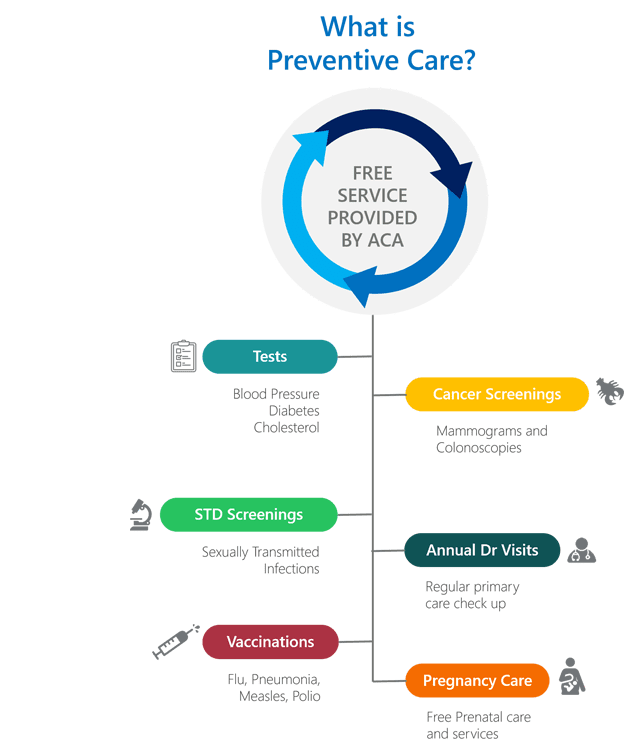

Preventative care encompasses a range of services designed to prevent illness and disease before they occur. This includes routine check-ups, vaccinations, screenings for various cancers and other conditions, and health education. While these services may seem like an added expense, the long-term benefits far outweigh the costs. Preventative care can detect potential health problems early, when treatment is often simpler, less invasive, and more affordable. Early detection significantly increases the chances of successful treatment and can even prevent serious illnesses from developing altogether.

The link between health insurance and preventative care is undeniable. Comprehensive health insurance plans typically cover a wide range of preventative services with little to no out-of-pocket costs. This removes a significant barrier to access, enabling individuals to prioritize their health and undergo regular check-ups and screenings. Without insurance, many people would forgo these essential services due to financial constraints, leading to delayed diagnoses and more costly treatments down the line.

Consider the example of regular cancer screenings. Early detection of cancers like breast, cervical, and colorectal cancer through mammograms, pap smears, and colonoscopies significantly improves the chances of survival. These screenings are often covered by health insurance plans, making them accessible to a wider population. For detailed information on the preventative care services covered by various plans in Waukesha, visit www.waukeshahealthinsurance.com. Delaying or forgoing these screenings due to cost can have devastating consequences.

Similarly, routine check-ups with a primary care physician are essential for maintaining good health. These visits allow for the monitoring of vital signs, early detection of potential problems, and personalized health advice. Regular check-ups can help identify and manage chronic conditions like hypertension, diabetes, and heart disease, preventing complications and improving overall health outcomes. Health insurance often covers these routine visits, encouraging individuals to establish a strong relationship with their primary care physician and prioritize their health.

Beyond physical health, preventative care also encompasses mental health. Mental health services, including therapy and counseling, are increasingly recognized as an essential component of overall well-being. Many health insurance plans now offer comprehensive coverage for mental health services, making them more accessible and affordable. Addressing mental health concerns early can prevent more serious issues from developing and improve an individual’s quality of life. Find a plan that prioritizes your mental and physical well-being at www.waukeshahealthinsurance.com.

The impact of preventative care extends beyond the individual. By preventing illness and promoting healthy lifestyles, preventative care contributes to a healthier population as a whole. This reduces the overall burden on the healthcare system, lowering healthcare costs in the long run. Investing in preventative care is a strategic approach to improving public health and reducing the strain on healthcare resources.

However, access to preventative care remains a challenge for many, particularly those without health insurance or with inadequate coverage. This highlights the crucial role of affordable and comprehensive health insurance in ensuring that everyone has access to the preventative services they need. The lack of insurance often leads to delayed or forgone care, resulting in more serious health problems and higher healthcare costs in the future.

The Affordable Care Act (ACA) in the United States, for example, has significantly expanded access to health insurance, making preventative care more accessible to millions. The ACA mandates that most health insurance plans cover a range of preventative services without cost-sharing. This has led to a significant increase in the utilization of preventative services and improved health outcomes. However, challenges remain, particularly in ensuring access for underserved populations and addressing the high cost of healthcare.

Choosing the right health insurance plan is crucial for maximizing access to preventative care. It’s important to carefully review the plan’s coverage details, paying close attention to the preventative services included and any associated cost-sharing. Compare plans and find the best fit for your needs at www.waukeshahealthinsurance.com. Factors such as the plan’s network of providers, deductibles, and co-pays should also be considered. Working with a health insurance broker or advisor can help navigate the complexities of choosing a plan that meets individual needs and budget.

In conclusion, health insurance plays a vital role in facilitating access to preventative care. By covering the costs of routine check-ups, screenings, and vaccinations, health insurance empowers individuals to prioritize their health and prevent illness before it occurs. Preventative care is not merely a cost; it’s an investment in long-term health and well-being, leading to better health outcomes, reduced healthcare costs, and a healthier population overall. Don’t delay your health; get the coverage you need today. Visit www.waukeshahealthinsurance.com. Investing in preventative care through comprehensive health insurance is an investment in a healthier future. It’s a lifeline, ensuring that individuals can take proactive steps to protect their health and well-being.