The Role of Health Insurance in Managing Health-Related Expenses-www.waukeshahealthinsurance.com

The Role of Health Insurance in Managing Health-Related Expenses

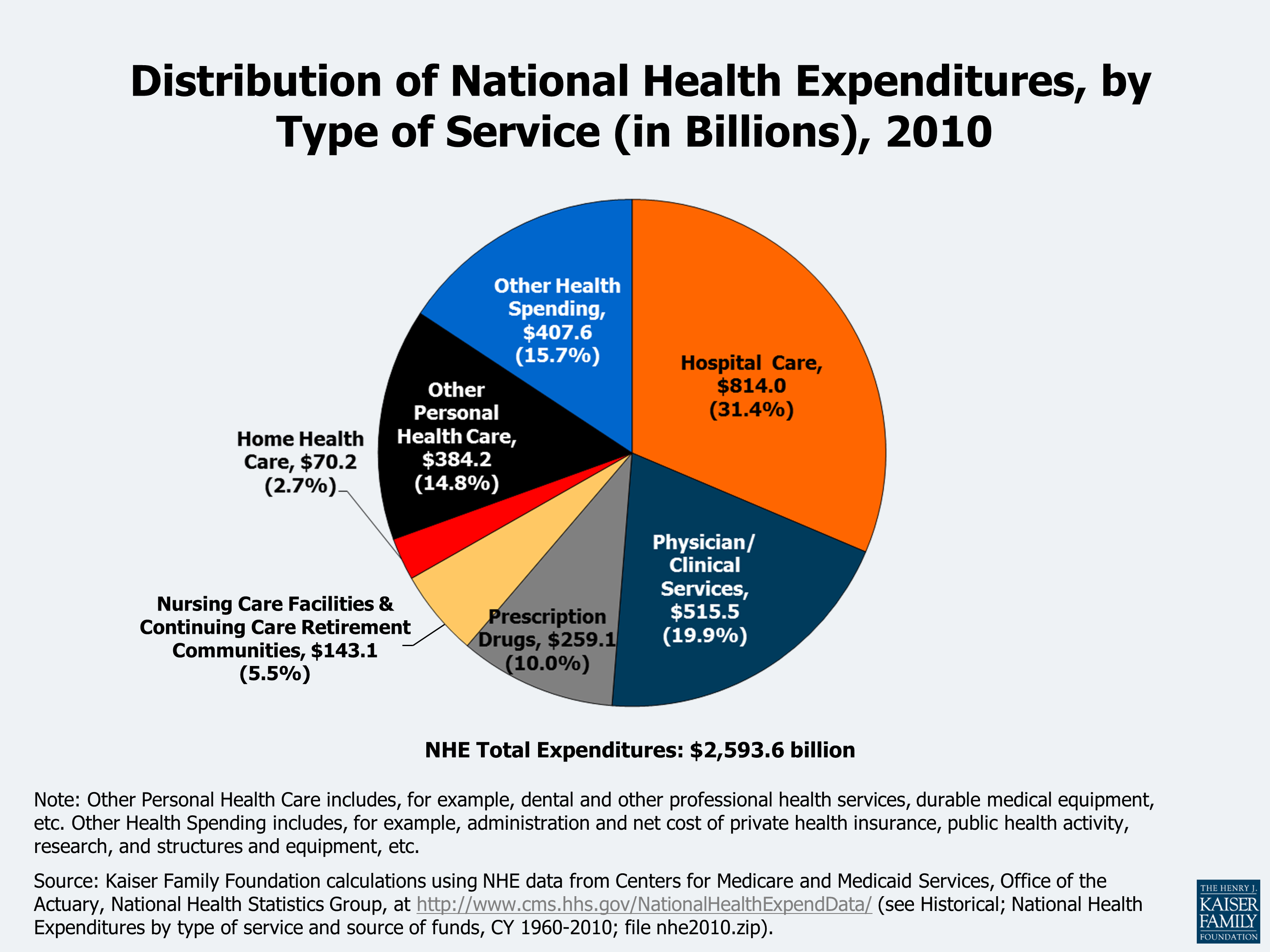

Healthcare costs are consistently rising, making access to quality medical care a significant concern for individuals and families across the globe. The unpredictable nature of illness and injury further complicates the financial burden, potentially leading to devastating consequences for those without adequate protection. This is where health insurance plays a crucial role, acting as a financial safety net and enabling individuals to manage health-related expenses effectively. Understanding the intricacies of health insurance and its impact on managing healthcare costs is paramount for navigating the complexities of the modern healthcare system.

Health insurance, in its simplest form, is a contract between an individual (or group) and an insurance company. In exchange for regular premium payments, the insurance company agrees to cover a portion or all of the insured individual’s medical expenses. This coverage can encompass a wide range of services, including doctor visits, hospital stays, surgeries, prescription drugs, and preventative care. The specific benefits covered and the extent of coverage vary significantly depending on the type of plan chosen and the individual’s circumstances.

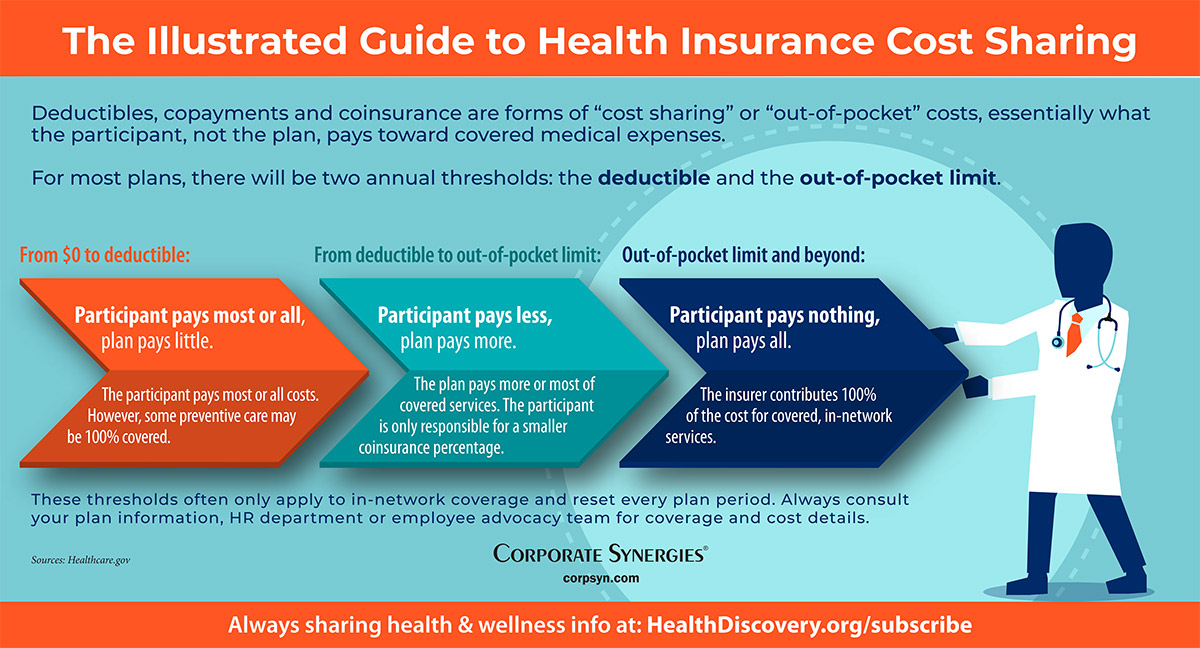

One of the primary benefits of health insurance is the reduction of out-of-pocket expenses. Without insurance, the full cost of medical treatment falls squarely on the individual. This can lead to significant financial hardship, especially in the case of unexpected illnesses or injuries requiring extensive treatment. Health insurance mitigates this risk by covering a substantial portion of the costs, leaving the insured individual responsible for only a smaller share, typically in the form of co-pays, deductibles, and coinsurance. Understanding these terms is crucial to selecting a plan that aligns with your individual needs and financial capabilities. For more information on understanding your policy and choosing the right plan, consider exploring resources available at www.waukeshahealthinsurance.com.

Different types of health insurance plans offer varying levels of coverage and cost-sharing. HMOs (Health Maintenance Organizations) typically require individuals to choose a primary care physician (PCP) within the network, who then refers them to specialists as needed. HMOs generally offer lower premiums but may have stricter limitations on out-of-network care. PPOs (Preferred Provider Organizations) offer more flexibility, allowing individuals to see specialists without a referral and providing coverage for out-of-network care, although at a higher cost. EPOs (Exclusive Provider Organizations) are similar to HMOs but generally offer slightly more flexibility in choosing specialists. Finally, POS (Point of Service) plans combine elements of both HMOs and PPOs, offering a balance between cost and flexibility. The best plan for an individual depends on their health needs, budget, and preferences. Finding the right plan can be challenging, but resources like those available at www.waukeshahealthinsurance.com can provide valuable guidance.

Beyond reducing out-of-pocket expenses, health insurance also plays a vital role in improving access to healthcare. Many individuals delay or forgo necessary medical care due to financial constraints. Health insurance removes this barrier, enabling individuals to seek timely treatment for illnesses and injuries, leading to better health outcomes and preventing potentially more serious and costly complications down the line. Preventative care, such as annual checkups and screenings, is also more accessible with health insurance, allowing for early detection and treatment of potential health problems, further reducing long-term healthcare costs.

Furthermore, health insurance offers protection against catastrophic medical expenses. Unexpected illnesses or accidents can lead to astronomical medical bills, potentially bankrupting individuals and families. Health insurance acts as a buffer against such financial devastation, providing coverage for even the most expensive treatments, such as major surgeries, hospitalizations, and long-term care. This financial security allows individuals to focus on their recovery rather than worrying about the overwhelming financial burden.

However, navigating the world of health insurance can be complex. Understanding the nuances of different plans, deductibles, co-pays, coinsurance, and out-of-pocket maximums is crucial for making informed decisions. Many individuals find it beneficial to consult with an insurance broker or agent to help them navigate the complexities and select a plan that best suits their needs. www.waukeshahealthinsurance.com offers a wealth of information and resources to help you understand your options and make informed choices.

The selection of a health insurance plan should be a personalized process, taking into account individual factors such as age, health status, income, and family circumstances. Factors such as the availability of employer-sponsored insurance, eligibility for government programs like Medicare or Medicaid, and the availability of individual market plans all play a significant role in determining the best course of action. Careful consideration of these factors, along with a thorough understanding of the different types of plans and their associated costs and benefits, is essential for making an informed decision. Don’t hesitate to utilize the resources available at www.waukeshahealthinsurance.com to aid in your decision-making process.

In addition to the core benefits, many health insurance plans offer supplementary benefits, such as dental and vision coverage. These additional benefits can further enhance the value of the insurance plan and provide comprehensive protection for a wider range of healthcare needs. The availability and extent of these supplementary benefits vary depending on the plan chosen, highlighting the importance of carefully reviewing the policy details before making a commitment. Remember, comparing plans and understanding the fine print is key to finding the best coverage for your needs. www.waukeshahealthinsurance.com can help you understand these supplementary benefits and how they can impact your overall healthcare costs.

In conclusion, health insurance plays a vital role in managing health-related expenses. It reduces out-of-pocket costs, improves access to healthcare, and provides protection against catastrophic medical expenses. While navigating the complexities of health insurance can be challenging, understanding the different types of plans, their associated costs and benefits, and utilizing available resources like those at www.waukeshahealthinsurance.com empowers individuals to make informed decisions and secure the financial protection they need to maintain their health and well-being. Choosing the right health insurance plan is a crucial step in securing your financial future and ensuring access to the quality healthcare you deserve. Remember to carefully review your options and seek professional guidance when needed to make the best choice for your unique circumstances.