Here’s a 1500-word article about how health insurance can prevent financial ruin, incorporating the requested link and underlined keywords:-www.waukeshahealthinsurance.com

Table of Content

Here’s a 1500-word article about how health insurance can prevent financial ruin, incorporating the requested link and underlined keywords:

How Health Insurance Can Prevent Financial Ruin

Unexpected illnesses and injuries can strike anyone, anytime. While we all hope to remain healthy, the reality is that medical emergencies can be incredibly expensive, potentially leading to devastating financial consequences. This is where health insurance steps in as a crucial safety net, preventing many from facing financial ruin. The cost of healthcare, especially in the United States, is notoriously high, and even a seemingly minor ailment can quickly spiral into a mountain of debt without adequate coverage. This article will explore the various ways health insurance protects individuals and families from the crippling financial burden of medical expenses.

The Crushing Weight of Uninsured Medical Bills

Imagine facing a serious illness like cancer or a debilitating accident requiring extensive surgery and rehabilitation. The medical bills alone can easily reach hundreds of thousands of dollars, not including lost wages due to time off work. For those without health insurance, these costs are often insurmountable, leading to a cascade of negative consequences:

- Medical Debt: The accumulation of unpaid medical bills can quickly overwhelm individuals and families, leading to significant debt. This debt can impact credit scores, making it difficult to obtain loans, rent an apartment, or even secure a job.

- Bankruptcy: In extreme cases, overwhelming medical debt can lead to bankruptcy, wiping out life savings and causing long-term financial instability. This is a particularly devastating outcome, especially for those already struggling financially.

- Missed or Delayed Treatment: The fear of incurring massive medical bills can lead individuals to delay or forgo necessary medical care, potentially worsening their condition and leading to more expensive treatments in the long run. This can have serious implications for overall health and well-being.

- Stress and Anxiety: The constant worry about mounting medical bills can cause significant stress and anxiety, negatively impacting mental and physical health. This added stress can further exacerbate existing health problems.

The Protective Shield of Health Insurance

Health insurance acts as a crucial buffer against these devastating financial consequences. By spreading the risk across a large pool of individuals, insurance companies can provide financial protection to those who need it most. The various types of coverage offer different levels of protection, but all aim to mitigate the financial burden of healthcare costs. Here’s how health insurance helps:

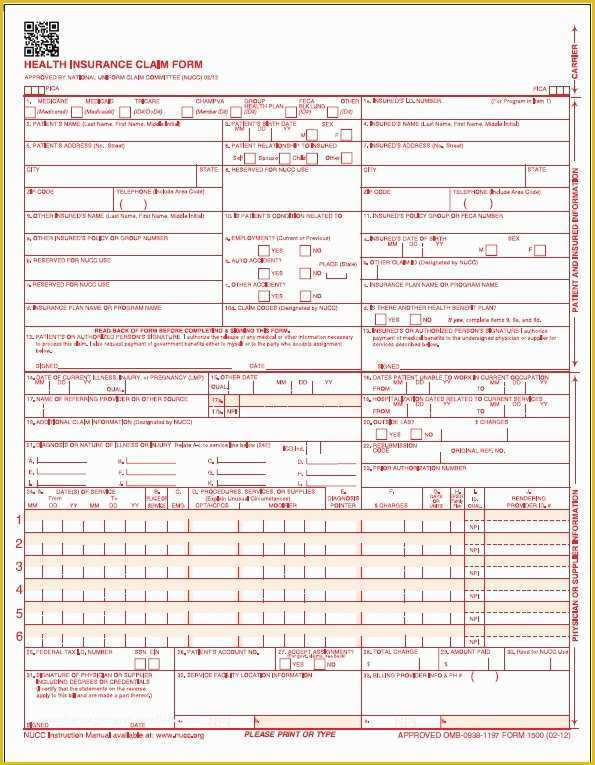

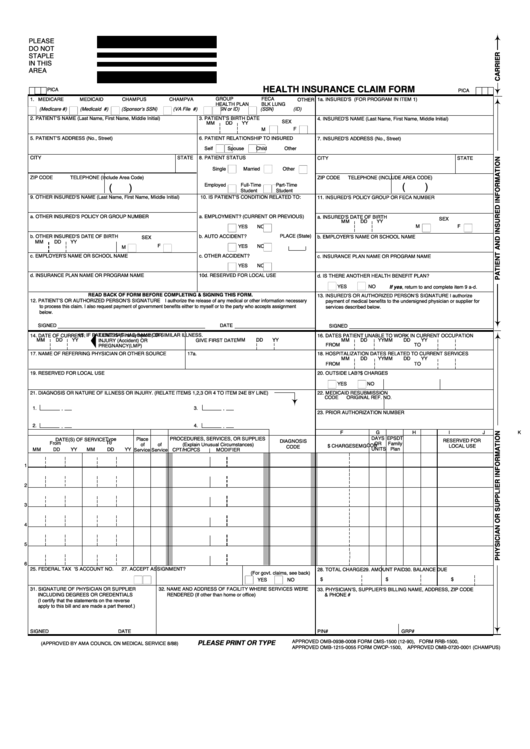

Coverage for Medical Expenses: Health insurance plans cover a wide range of medical expenses, including doctor visits, hospital stays, surgeries, prescription drugs, and diagnostic tests. The specific coverage varies depending on the plan, but even basic plans offer significant protection. To find the right plan for your needs, consider exploring options from reputable providers like those found at www.waukeshahealthinsurance.com. They offer a range of plans tailored to different needs and budgets.

Reduced Out-of-Pocket Costs: Even with insurance, individuals still have to pay some costs out-of-pocket, such as deductibles, co-pays, and coinsurance. However, these costs are significantly lower than the total cost of care without insurance. Choosing a plan with a lower deductible and co-pay can further reduce your financial burden. www.waukeshahealthinsurance.com can help you compare plans and find one that fits your budget.

Preventive Care Coverage: Many health insurance plans cover preventive care services, such as annual checkups, vaccinations, and screenings. These services can help detect and prevent health problems early on, reducing the need for more expensive treatments later. This proactive approach to healthcare can save you money in the long run.

Mental Health Coverage: The importance of mental health is increasingly recognized, and many health insurance plans now include coverage for mental health services, including therapy and medication. This coverage is crucial, as mental health conditions can be just as expensive and debilitating as physical health conditions. Find a plan that prioritizes mental health coverage by visiting www.waukeshahealthinsurance.com.

Prescription Drug Coverage: Prescription drugs can be incredibly expensive, especially for those with chronic conditions. Health insurance plans often include prescription drug coverage, reducing the cost of medications and ensuring access to necessary treatments. This is particularly important for managing chronic illnesses and preventing costly hospitalizations.

Choosing the Right Health Insurance Plan

Choosing the right health insurance plan is crucial to maximizing its benefits. Several factors should be considered:

- Your Health Needs: Consider your current health status and any pre-existing conditions. Some plans may have limitations on coverage for pre-existing conditions.

- Your Budget: Health insurance premiums, deductibles, and co-pays can vary significantly. Choose a plan that fits your budget while still providing adequate coverage.

- Your Employer’s Benefits: If you have employer-sponsored health insurance, carefully review the plan options available. Many employers offer a range of plans with different levels of coverage and costs.

- Your Network of Doctors and Hospitals: Check the plan’s network of providers to ensure that your preferred doctors and hospitals are included. Seeing out-of-network providers can significantly increase your out-of-pocket costs.

The Long-Term Benefits of Health Insurance

The benefits of health insurance extend far beyond simply avoiding financial ruin. It provides peace of mind, knowing that you have a safety net in place should a medical emergency occur. This peace of mind can reduce stress and anxiety, allowing you to focus on your health and recovery. Furthermore, health insurance encourages preventative care, leading to better overall health and well-being. By investing in health insurance, you are investing in your long-term health and financial security. For more information and to find a plan that best suits your needs, visit www.waukeshahealthinsurance.com. They offer personalized assistance to help you navigate the complexities of health insurance and find the best coverage for you and your family.

Conclusion

Health insurance is not just a financial product; it’s a crucial investment in your health and well-being. It protects individuals and families from the potentially devastating financial consequences of unexpected illnesses and injuries. While the cost of healthcare continues to rise, health insurance remains an essential tool for mitigating the financial burden and ensuring access to necessary medical care. By understanding the various types of coverage and choosing the right plan, you can protect yourself and your loved ones from financial ruin and secure a healthier, more financially stable future. Don’t hesitate to explore your options and find the best fit for your needs at www.waukeshahealthinsurance.com. Your financial security and well-being depend on it.