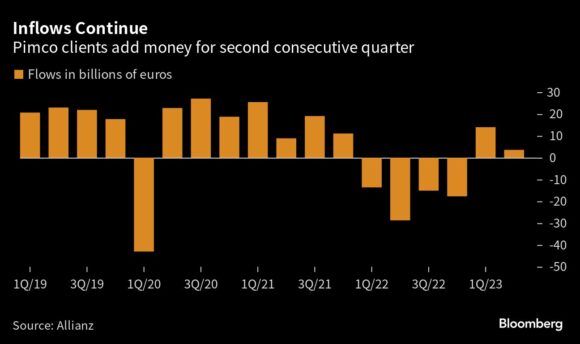

Group operating profit rose 7.1% to 3.8 billion ($4.2 billion) on top results from its U.S. life health insurance business, Allianz said Thursday. The asset management division, which includes Allianz Global Investors, posted lower earnings following a historic bond meltdown. Pimco has attracted around 4 billion euros from foreign clients in three months to stabilize investor confidence.

CEO Oliver Baete is in the midst of a three-year strategic plan to generate billions in surplus capital through 2024, targeting continued high growth, improved profitability and efficient capital management. He avoided large acquisitions, paving the way for stock buybacks and higher dividends. An expensive legal dispute In the US

Profits from property-casualty insurance grew 10.8 percent, while life-health insurance saw a 22.5 percent increase. Property management units recorded a 9 percent decline.

Allianz confirmed its operating target for this year, which corresponds to last year’s revenue of 14.2 billion euros.

“Overall, these results highlight the fundamental quality of the business, and we think the shares should be well received,” wrote Deutsche Bank AG analyst Hadley Cohen.

Allianz shares were trading 3.5% higher in Frankfurt at 9:34 a.m. local time.

Allianz foreign clients increased their spending at Pimco for the second consecutive quarter after spending more than 75 billion euros last year.

“There is stability coming,” Allianz Chief Financial Officer Giulio Terzariol said in an interview with Bloomberg TV, adding that the flow in July was positive. “We are optimistic that we will continue to see positive flows at PIMCO as we move into the rest of the year,” he said.

Allianz has carried out €11 billion of share buybacks since February 2017 before announcing another €1.5 billion program in May. After a reported operating profit for 2022, Baete raised its dividend.

Some analysts expect Allianz to return more capital to shareholders before the end of this year. Hamburg-based Berenberg predicted another 1 billion euro acquisition could be announced with third-quarter earnings, according to a July note.

Those promises come after Baye said he is in no rush to make big deals. “Large M&A transactions are less likely to succeed,” Baete said in a June interview. “And there should be interesting big landing targets. I haven’t seen any.”

Copyright 2024 Bloomberg.

Topics

America

Loss of profit

Allianz

interested in Health insurance?

Get automatic alerts for this topic.