The Benefits of Health Insurance for Small Business Owners-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

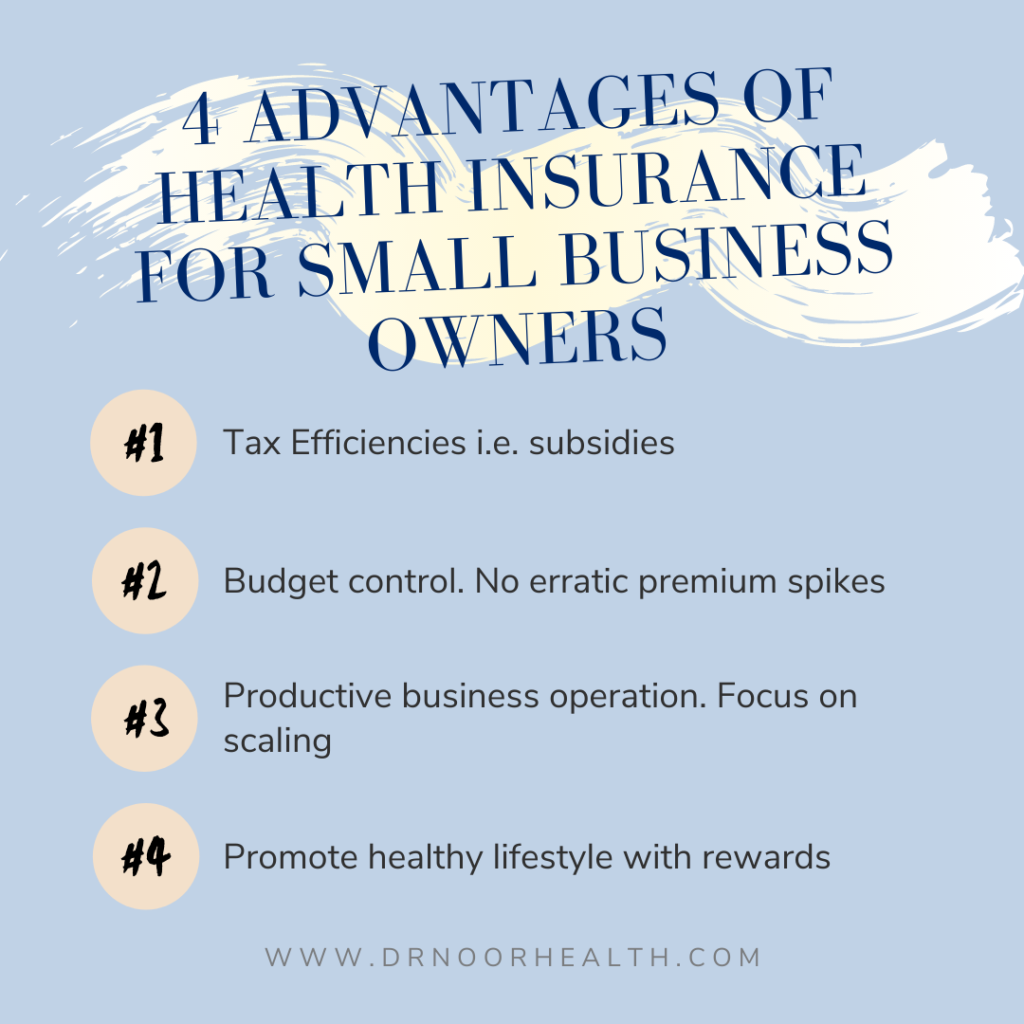

This is where health insurance steps in, offering a vital safety net that protects both the individuals and the future of the business. Failing to secure adequate health insurance can have significant repercussions, impacting not only the financial stability of the business but also the morale and productivity of its workforce. This article explores the numerous benefits of health insurance for small business owners, highlighting why it’s not just a cost, but a strategic investment.

Attracting and Retaining Top Talent: In today’s competitive job market, offering comprehensive health insurance is no longer a perk; it’s a necessity. Many prospective employees, particularly skilled individuals, prioritize health insurance when considering job offers. Providing a robust health insurance plan allows small businesses to attract and retain top talent, reducing costly employee turnover and the associated recruitment expenses. A strong benefits package, including health insurance, showcases a company’s commitment to its employees’ well-being, fostering loyalty and increasing job satisfaction. This, in turn, leads to improved productivity and a more positive work environment. Imagine the difference between struggling to find qualified employees and having a pool of applicants eager to join your team because of the attractive benefits package you offer. This competitive edge can be the difference between success and stagnation.

Protecting Against Catastrophic Medical Expenses: Unexpected illnesses or injuries can devastate a small business owner’s personal finances. A single major medical event can wipe out savings and leave the business vulnerable. Health insurance acts as a crucial buffer, mitigating the financial burden of unexpected healthcare costs. From hospital stays and surgeries to ongoing treatments and medications, health insurance helps cover a significant portion of these expenses, preventing a potentially crippling financial blow. Without this protection, a serious health issue could easily force a business owner to close shop, highlighting the importance of securing adequate coverage. Understanding the various types of health insurance plans available is crucial to making an informed decision that best suits your business’s needs and budget. Exploring options such as HMOs, PPOs, and POS plans will allow you to choose the plan that provides the best value for your investment.

Improving Employee Morale and Productivity: Employees who are healthy and feel secure in their health are more likely to be productive and engaged. Knowing that they have access to quality healthcare reduces stress and anxiety, allowing them to focus on their work. This translates into improved efficiency, reduced absenteeism, and a more positive work environment. Investing in your employees’ health is an investment in your business’s success. A healthy workforce is a productive workforce, contributing directly to the bottom line. The positive impact on morale alone is invaluable, fostering a sense of loyalty and appreciation among your employees.

Boosting Business Reputation and Credibility: Offering health insurance demonstrates a commitment to social responsibility and strengthens a company’s reputation. In today’s increasingly socially conscious world, customers and clients are more likely to support businesses that prioritize the well-being of their employees. This positive image can attract new customers and build stronger relationships with existing ones. A company that values its employees’ health is perceived as a responsible and ethical organization, enhancing its overall credibility and market standing. This positive brand image can be a powerful marketing tool, attracting not only employees but also customers who share similar values.

Tax Advantages: The cost of providing health insurance to employees is often tax-deductible, offering a significant financial benefit to small business owners. This deduction can reduce the overall tax burden, making health insurance a more affordable option than it might initially appear. Understanding the tax implications of health insurance is crucial for maximizing the financial benefits. Consulting with a tax professional can help you navigate the complexities of tax deductions and ensure you are taking full advantage of available benefits.

Reduced Employee Turnover and Recruitment Costs: As mentioned earlier, offering health insurance significantly reduces employee turnover. The cost of replacing an employee is substantial, encompassing recruitment fees, training expenses, and lost productivity during the transition period. By retaining employees through competitive benefits, small businesses can save significantly on these costs. This financial stability allows for reinvestment in other areas of the business, fostering growth and expansion.

Compliance with Legal Requirements: In some cases, providing health insurance may be a legal requirement, depending on the size and structure of the business. Failing to comply with these regulations can result in significant penalties and legal repercussions. Understanding the legal obligations related to employee health insurance is crucial to avoiding costly fines and legal battles. Staying informed about relevant legislation and regulations ensures your business remains compliant and avoids potential legal issues.

Peace of Mind for Business Owners and Employees: Perhaps the most significant benefit of health insurance is the peace of mind it provides. Knowing that they have access to quality healthcare reduces stress and anxiety for both business owners and employees. This improved mental well-being contributes to a more positive and productive work environment. The sense of security provided by health insurance is invaluable, allowing individuals to focus on their work and personal lives without the constant worry of unexpected medical expenses.

Choosing the Right Health Insurance Plan: Selecting the appropriate health insurance plan is crucial for maximizing benefits and minimizing costs. Several factors should be considered, including the size of the business, the budget, and the specific needs of the employees. Consulting with a qualified health insurance broker can be invaluable in navigating the complexities of choosing the right plan. A broker can provide expert advice, compare different plans, and help you find the most suitable option for your business. They can also assist with enrollment and ongoing administration, simplifying the process and ensuring compliance with all relevant regulations.

The Bottom Line: Investing in health insurance for your small business is not just an expense; it’s a strategic investment in the long-term success and sustainability of your enterprise. From attracting and retaining top talent to mitigating financial risks and improving employee morale, the benefits are numerous and far-reaching. By prioritizing the health and well-being of your employees, you are investing in a more productive, engaged, and loyal workforce, ultimately contributing to the growth and prosperity of your business. Don’t overlook this crucial aspect of business management; secure adequate health insurance and reap the rewards. Contact a health insurance specialist today to explore your options and find the perfect plan for your business needs. The peace of mind and long-term benefits are well worth the investment.