Health Insurance for Young Adults: What You Need to Know-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

Leaving the familiar safety net of your parents’ plan can be daunting, but securing your own health insurance is crucial for protecting your financial well-being and ensuring access to necessary medical care. This article will guide you through the essential aspects of health insurance for young adults, helping you make informed decisions and find the right coverage for your needs.

Why Health Insurance is Crucial for Young Adults:

While youth often equates to good health, accidents and illnesses can happen at any age. A sudden injury, a chronic condition diagnosis, or even a routine checkup can quickly become financially crippling without health insurance. The costs associated with emergency room visits, hospital stays, surgeries, and prescription medications can easily reach tens of thousands of dollars. Health insurance acts as a safety net, mitigating these potentially devastating financial burdens.

Beyond the financial protection, health insurance facilitates preventative care. Regular checkups, screenings, and vaccinations are vital for maintaining good health and detecting potential problems early. Ignoring these preventative measures can lead to more serious and costly health issues down the line. Health insurance often covers these preventative services, encouraging proactive health management.

Understanding Your Options:

Several avenues are available for young adults seeking health insurance:

Staying on a Parent’s Plan: The Affordable Care Act (ACA) allows young adults to remain on their parents’ health insurance plans until age 26, regardless of their marital status or student status. This is a significant benefit, offering continued coverage and financial stability during a crucial transition period. However, it’s important to understand the limitations and potential costs associated with staying on a parent’s plan, such as higher premiums or limited coverage options compared to individual plans.

Employer-Sponsored Insurance: If you’re employed, your employer may offer health insurance as a benefit. This is often a cost-effective option, with the employer contributing a portion of the premiums. Carefully review the plan details, including coverage levels, deductibles, co-pays, and out-of-pocket maximums, to ensure it meets your needs. Learn more about employer-sponsored plans and how to choose the right one for you by visiting our website. [www.waukeshahealthinsurance.com]

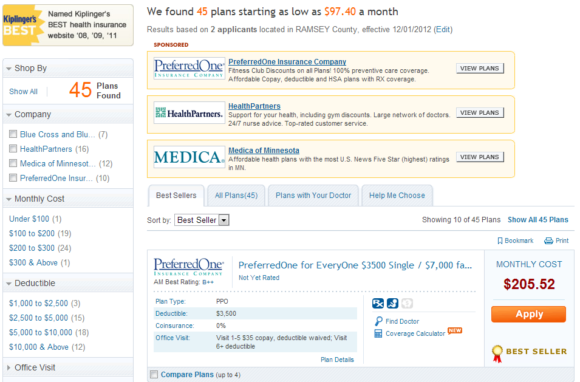

Individual Health Insurance Marketplace: The ACA established health insurance marketplaces (also known as exchanges) where individuals can purchase health insurance plans. These marketplaces offer a variety of plans from different insurance providers, allowing you to compare options and choose the plan that best suits your budget and health needs. Our experts at Waukesha Health Insurance can guide you through the process of navigating the marketplace and selecting the ideal plan. [www.waukeshahealthinsurance.com]

Medicaid and CHIP: Medicaid and the Children’s Health Insurance Program (CHIP) provide low-cost or no-cost health coverage to eligible individuals and families. Eligibility requirements vary by state, but these programs can be a lifeline for young adults with limited incomes. Check your state’s eligibility requirements to see if you qualify for Medicaid or CHIP. [www.waukeshahealthinsurance.com – This link will direct you to a resource page with links to state Medicaid websites]

Key Terms to Understand:

Before selecting a health insurance plan, familiarize yourself with these essential terms:

- Premium: The monthly payment you make to maintain your health insurance coverage.

- Deductible: The amount you pay out-of-pocket for healthcare services before your insurance coverage kicks in.

- Co-pay: A fixed amount you pay for a doctor’s visit or other healthcare services.

- Coinsurance: The percentage of costs you share with your insurance company after you’ve met your deductible.

- Out-of-pocket maximum: The maximum amount you’ll pay out-of-pocket for covered healthcare services in a given year.

- Network: The group of doctors, hospitals, and other healthcare providers your insurance plan covers. Choosing a plan with a wide network is crucial for ensuring access to care.

Factors to Consider When Choosing a Plan:

- Your Budget: Consider your monthly income and how much you can comfortably afford to pay in premiums.

- Your Health Needs: If you have pre-existing conditions or anticipate needing frequent medical care, you’ll want a plan with comprehensive coverage.

- Your Doctor: Check if your preferred doctor is in the plan’s network.

- Prescription Medications: If you take prescription medications, ensure the plan covers them.

- Mental Health Coverage: Mental health services are crucial, and you should ensure your plan provides adequate coverage.

Navigating the Process:

Choosing the right health insurance plan can be challenging. We recommend seeking professional guidance from a qualified insurance broker. [www.waukeshahealthinsurance.com] They can help you understand your options, compare plans, and select the best coverage for your individual needs. They can also assist with the enrollment process and answer any questions you may have.

The Importance of Continuous Coverage:

Maintaining continuous health insurance coverage is crucial. Gaps in coverage can lead to higher premiums in the future and limit your access to affordable healthcare. If you lose your job or change your employment status, explore your options for maintaining coverage immediately to avoid any potential penalties or higher costs.

Staying Informed:

The world of health insurance is constantly evolving. Stay informed about changes in regulations, plan options, and coverage details. Regularly review your plan’s summary of benefits and coverage to ensure it continues to meet your needs. [www.waukeshahealthinsurance.com – This link will direct you to a resource page with tips on reviewing your plan]

Conclusion:

Securing health insurance as a young adult is a vital step towards protecting your financial well-being and ensuring access to quality healthcare. By understanding your options, considering your individual needs, and seeking professional guidance, you can confidently navigate the process and find the right plan to safeguard your health and future. Don’t hesitate to reach out to experts for assistance; your health and financial security are worth the effort. Contact us today at Waukesha Health Insurance to discuss your options. [www.waukeshahealthinsurance.com]