What Are the Hidden Costs of Health Insurance Plans?-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

However, the advertised premiums often represent only a fraction of the true cost. Many individuals and families are surprised by hidden fees and unexpected out-of-pocket expenses that significantly impact their budgets. Understanding these hidden costs is crucial to choosing a plan that truly meets your needs and avoids financial strain. This article delves into the often-overlooked expenses associated with health insurance, empowering you to make informed decisions about your coverage.

1. Premiums: The Tip of the Iceberg

While premiums are the most obvious cost, they only represent the monthly payment for your insurance coverage. Many plans require significant upfront payments, such as deductibles and co-pays, before coverage kicks in. The premium itself can also fluctuate based on factors like your age, health status, and location. It’s vital to carefully review the premium structure and understand how it changes over time. For a personalized analysis of premium costs in your area, contact us at Waukesha Health Insurance.

2. Deductibles: The Initial Hurdle

Your deductible is the amount you must pay out-of-pocket before your insurance coverage begins. This can range from a few hundred dollars to tens of thousands, depending on your plan. Reaching your deductible can be a significant financial burden, particularly for unexpected medical emergencies. Understanding your deductible and how quickly you anticipate reaching it is crucial in assessing the true cost of your plan. Explore different deductible options and find the right fit for your budget by visiting our website: www.waukeshahealthinsurance.com

3. Co-pays and Co-insurance: Ongoing Expenses

Even after meeting your deductible, you’ll likely still face out-of-pocket costs. Co-pays are fixed fees you pay for doctor visits or other services, while co-insurance is a percentage of the cost you pay after meeting your deductible. These ongoing expenses can add up quickly, especially with frequent medical visits or unexpected illnesses. Our team at Waukesha Health Insurance can help you compare plans with varying co-pay and co-insurance structures to find the most cost-effective option for your needs.

4. Out-of-Pocket Maximums: A Limit, But Still Significant

The out-of-pocket maximum is the most you’ll pay out-of-pocket in a given year. While this provides a ceiling on your expenses, it’s still a substantial amount that needs careful consideration. Reaching this maximum often requires significant medical expenses, potentially indicating a serious health issue. Understanding your out-of-pocket maximum helps you budget for potential high-cost scenarios. For detailed information on out-of-pocket maximums and how they impact your overall cost, consult our comprehensive guides at www.waukeshahealthinsurance.com

5. Prescription Drug Costs: A Major Expense

Prescription drugs can be incredibly expensive, and even with insurance, you may face significant costs. Your plan’s formulary, which lists covered medications and their cost-sharing levels, plays a crucial role in determining your out-of-pocket expenses. Tiered formularies, where drugs are categorized by cost, can lead to substantial differences in your payments. Compare formularies across different plans to ensure your necessary medications are covered at an affordable price. We can assist you with this process at Waukesha Health Insurance.

6. Network Restrictions: Limiting Your Choices

Many health insurance plans operate within specific networks of doctors and hospitals. Seeing providers outside your network can result in significantly higher out-of-pocket costs, or even complete denial of coverage. Choosing a plan with a broad network that includes your preferred doctors and hospitals is crucial to avoid these hidden expenses. Use our network search tool on our website, www.waukeshahealthinsurance.com, to verify your preferred providers are in-network before enrolling in a plan.

7. Administrative Fees and Other Charges:

Beyond premiums, deductibles, and co-pays, you might encounter various administrative fees, such as late payment penalties, or charges for specific services not fully covered by your plan. These smaller charges can accumulate over time, adding to your overall healthcare expenses. Carefully review your Explanation of Benefits (EOB) statements to identify and address any unexpected charges.

8. Lack of Transparency and Hidden Fees:

The complexity of health insurance plans often leads to a lack of transparency, making it difficult to understand the true cost. Hidden fees and unexpected charges can easily catch you off guard. We strive for transparency at Waukesha Health Insurance. Contact us to discuss any questions or concerns about your plan’s costs.

9. Inflation and Rising Healthcare Costs:

Healthcare costs are constantly rising, impacting both premiums and out-of-pocket expenses. Your plan’s costs may increase year over year, requiring adjustments to your budget. Staying informed about healthcare cost trends and potential plan changes is crucial to managing your healthcare finances effectively.

10. The Cost of Preventive Care:

While preventive care is essential for maintaining good health, some plans may not fully cover these services. Understanding your plan’s coverage for preventative screenings, vaccinations, and wellness visits is crucial in managing long-term healthcare costs. We can help you analyze the preventive care coverage offered by various plans at Waukesha Health Insurance.

11. Mental Health and Substance Abuse Treatment:

The cost of mental health and substance abuse treatment can be substantial. Ensure your plan offers adequate coverage for these essential services, as they are often underinsured. Check your plan’s coverage details for mental health and substance abuse treatment to avoid unexpected expenses.

12. Travel and Emergency Expenses:

If you travel frequently, consider your plan’s coverage for out-of-network care and emergency services in other locations. Unexpected medical emergencies while traveling can lead to significant expenses if your plan doesn’t offer adequate coverage.

13. Gaps in Coverage:

Even with comprehensive insurance, there might be gaps in coverage for specific procedures, treatments, or medications. Understanding these gaps is crucial in avoiding unexpected financial burdens.

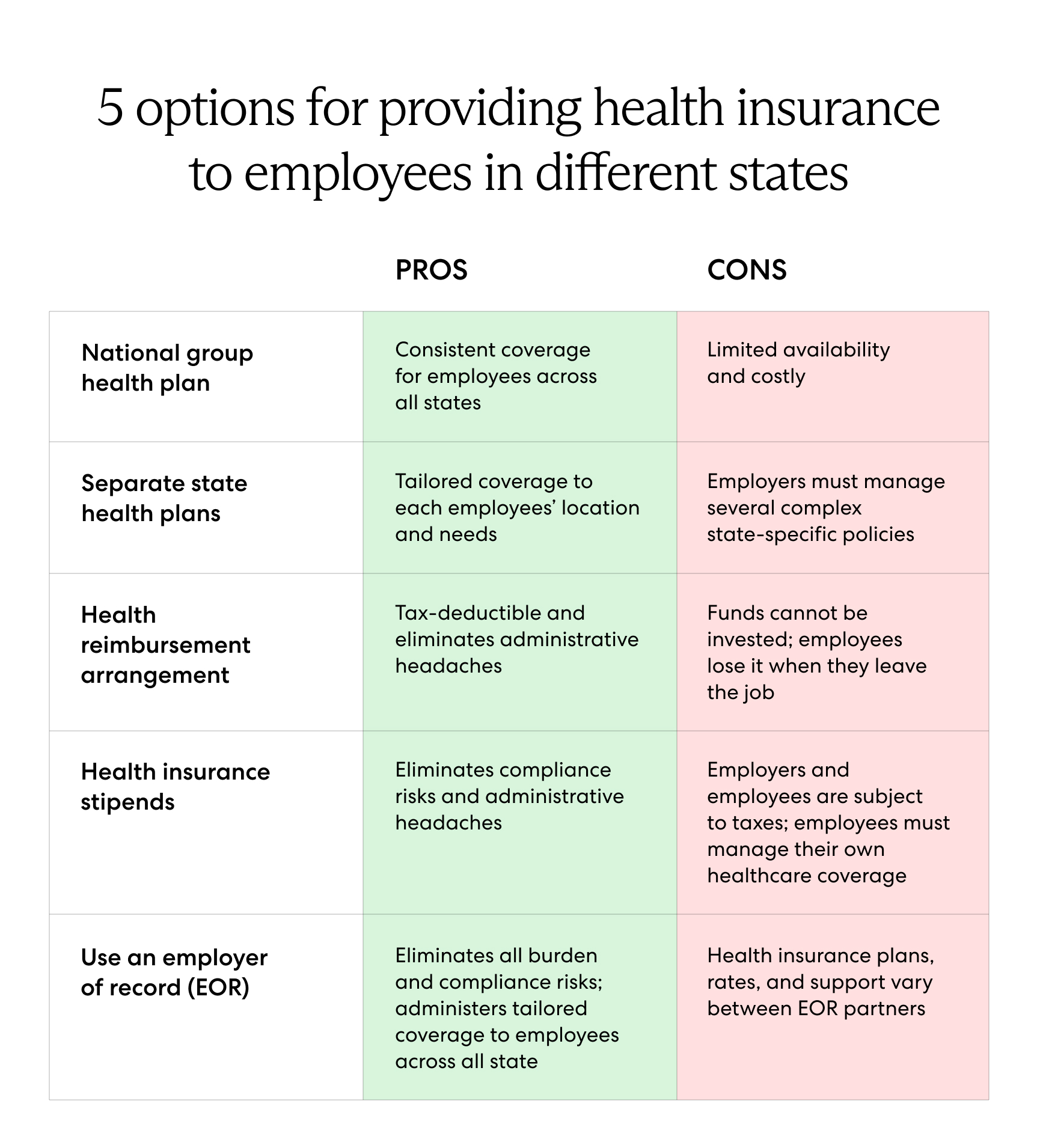

14. Choosing the Right Plan:

Choosing the right health insurance plan requires careful consideration of your individual needs and financial situation. Factors like your age, health status, and expected healthcare utilization should all be taken into account.

15. Seeking Professional Guidance:

Navigating the complexities of health insurance can be overwhelming. Seeking guidance from a qualified insurance broker or advisor can help you make informed decisions and avoid costly mistakes. Contact Waukesha Health Insurance today for a personalized consultation.

By understanding these hidden costs, you can make a more informed decision when choosing a health insurance plan. Remember to carefully review the details of each plan, compare options, and seek professional advice to ensure you select the best coverage for your individual needs and budget. Don’t let unexpected expenses derail your financial stability; be proactive and informed about the true cost of your health insurance.