How to Track Your Health Insurance Spending and Save Money-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

Include columns for the date of service, provider, description of service, amount billed, amount paid by insurance, and your out-of-pocket cost.

3. Analyzing Your Spending:

Once you’ve collected your data, it’s time to analyze it. Look for patterns and trends in your spending. Are there specific services or providers that consistently result in higher out-of-pocket costs? Are you exceeding your deductible or approaching your out-of-pocket maximum? Identifying these trends can help you make informed decisions about your future healthcare choices.

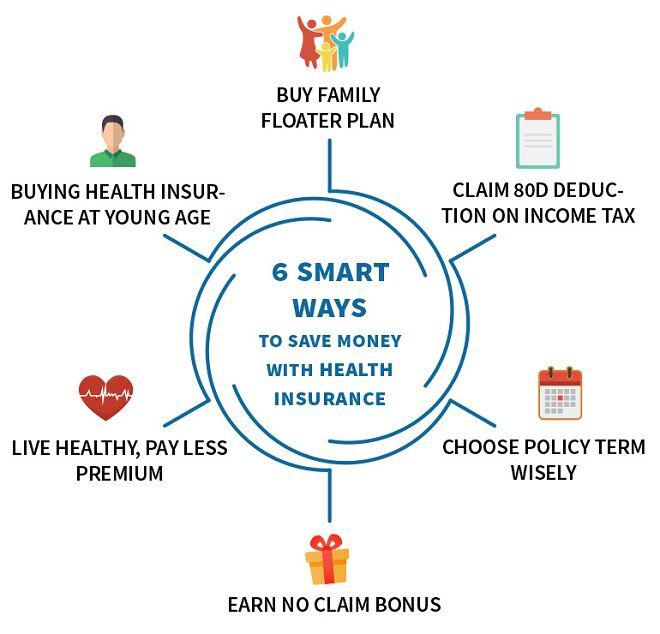

4. Strategies for Saving Money:

Once you understand your spending patterns, you can implement strategies to save money:

- Utilize In-Network Providers: Using in-network providers significantly reduces your out-of-pocket costs. Check your insurance plan’s provider directory to find in-network options.

- Negotiate Medical Bills: Don’t hesitate to negotiate medical bills, especially if you’re facing a high out-of-pocket cost. Many providers are willing to work with patients to create payment plans or reduce charges.

- Shop Around for Prescription Drugs: Prescription drug costs can vary significantly between pharmacies. Use online tools or apps to compare prices and find the most affordable option.

- Consider Generic Medications: Generic medications are typically much cheaper than brand-name drugs and are often just as effective.

- Preventive Care: Regular preventive care, such as annual checkups and screenings, can help prevent more expensive health problems down the line. Many insurance plans cover preventive care at no cost to you.

- HSA or FSA: A Health Savings Account (HSA) or Flexible Spending Account (FSA) can help you save money on healthcare expenses. These accounts allow you to set aside pre-tax dollars to pay for eligible medical expenses. Consult with a financial advisor or tax professional to determine which option is best for you.

- Review Your Plan Annually: Health insurance plans change frequently. Review your plan annually to ensure it still meets your needs and budget. Consider switching plans if a more cost-effective option becomes available. www.waukeshahealthinsurance.com can assist you in comparing plans and finding the best fit.

5. Seeking Professional Help:

If you’re struggling to manage your health insurance costs or need assistance navigating your plan, don’t hesitate to seek professional help. A qualified insurance broker can provide guidance and support. For residents of Waukesha, Wisconsin, www.waukeshahealthinsurance.com offers expert advice and assistance in finding the right health insurance plan for your individual circumstances.

Conclusion:

Tracking your health insurance spending is crucial for managing your healthcare costs and making informed decisions. By utilizing the methods and strategies outlined in this article, you can gain control over your healthcare finances and save money. Remember to leverage the resources available to you, including your insurance provider’s online portal and the expertise of qualified professionals. Taking a proactive approach to managing your health insurance will not only save you money but also provide you with peace of mind knowing you’re making the most of your coverage. Don’t hesitate to explore the resources available at www.waukeshahealthinsurance.com to find the support you need in navigating the world of health insurance.