Affordable Health Insurance for Families-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

The rising premiums, deductibles, and out-of-pocket expenses can feel overwhelming, making it challenging to secure adequate health coverage without breaking the bank. Finding affordable health insurance for your family requires careful planning, research, and understanding of the available options. This article aims to guide you through the process, providing valuable insights and resources to help you make informed decisions.

Understanding Your Needs:

Before diving into the specifics of plans and providers, it’s crucial to assess your family’s healthcare needs. Consider the following factors:

- Number of family members: The more people you need to cover, the higher the cost will likely be.

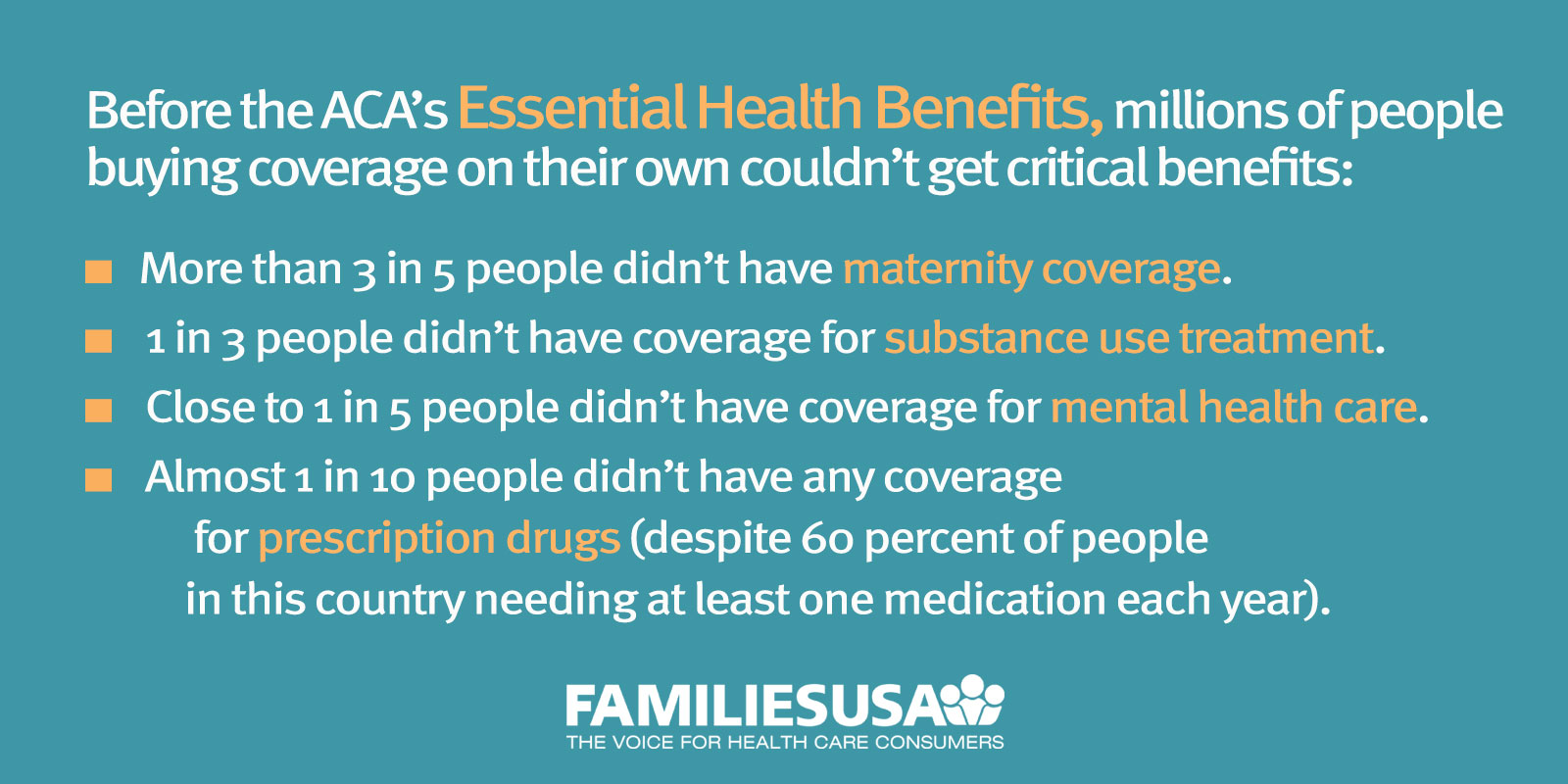

- Pre-existing conditions: Conditions like diabetes, heart disease, or asthma can significantly impact premium costs. The Affordable Care Act (ACA) prohibits insurers from denying coverage based on pre-existing conditions, but it can still affect the cost of your plan.

- Current health status: If your family is generally healthy, you might be able to opt for a plan with a higher deductible and lower premiums. However, if you anticipate significant healthcare needs, a plan with lower out-of-pocket costs might be more suitable.

- Prescription medications: The cost of prescription drugs can be substantial. Ensure your chosen plan covers the medications your family requires and check the formulary (list of covered drugs) carefully.

- Location: Healthcare costs vary geographically. Your location will influence the available plans and their associated costs.

Exploring Your Options:

Several avenues exist for obtaining affordable health insurance for your family:

Marketplace Plans (ACA): The Affordable Care Act created health insurance marketplaces where individuals and families can compare and purchase plans from various insurers. These marketplaces offer subsidies (tax credits) to help lower the cost of premiums for those who qualify based on income. Visit our website at www.waukeshahealthinsurance.com to learn more about navigating the marketplace and finding plans that suit your needs.

Employer-Sponsored Insurance: Many employers offer health insurance as a benefit to their employees. This can often be a more affordable option than purchasing insurance individually, as employers typically contribute a portion of the premium. However, the quality and affordability of employer-sponsored plans can vary significantly.

Medicaid and CHIP: Medicaid and the Children’s Health Insurance Program (CHIP) provide low-cost or free health coverage to eligible families with low incomes. Eligibility requirements vary by state.

Medicare: If you or a family member is 65 or older or has a qualifying disability, you may be eligible for Medicare. Medicare offers various coverage options, each with its own costs and benefits.

COBRA: If you lose your job and your employer-sponsored insurance, you may be able to continue your coverage through COBRA for a limited time. However, COBRA premiums are typically very high.

Key Considerations When Choosing a Plan:

- Premium: This is the monthly payment you make for your health insurance.

- Deductible: This is the amount you must pay out-of-pocket before your insurance begins to cover expenses.

- Copay: This is a fixed amount you pay for a doctor’s visit or other services.

- Coinsurance: This is the percentage of costs you share with your insurer after you’ve met your deductible.

- Out-of-pocket maximum: This is the maximum amount you’ll pay out-of-pocket in a year. Once you reach this limit, your insurance will cover 100% of your expenses.

- Network: This is the group of doctors, hospitals, and other healthcare providers that your insurance plan covers. Choosing a plan with a wide network is crucial for ensuring access to quality care.

Tips for Finding Affordable Health Insurance:

- Shop around: Compare plans from different insurers to find the best value for your money. Use online comparison tools and resources like www.waukeshahealthinsurance.com to simplify this process.

- Consider a high-deductible health plan (HDHP) with a health savings account (HSA): HDHPs have lower premiums but higher deductibles. An HSA allows you to save pre-tax money to pay for healthcare expenses.

- Take advantage of subsidies and tax credits: If you qualify, utilize the financial assistance available through the ACA marketplace.

- Negotiate with your provider: If you have a pre-existing condition or anticipate significant healthcare needs, try negotiating with your insurer to lower your premium or improve your coverage.

- Maintain a healthy lifestyle: Preventing illness through healthy habits can help reduce your healthcare costs in the long run.

The Importance of Health Insurance:

Health insurance is not just a financial tool; it’s a crucial component of family well-being. Unexpected illnesses or injuries can lead to devastating financial burdens without adequate coverage. Health insurance provides peace of mind, knowing that you have access to necessary medical care without the fear of crippling debt. For assistance in finding the right plan for your family, contact the experts at www.waukeshahealthinsurance.com.

Conclusion:

Finding affordable health insurance for your family can be a complex undertaking, but it’s a crucial step in securing your family’s financial and physical well-being. By carefully considering your needs, exploring your options, and understanding the key features of different plans, you can make an informed decision that provides adequate coverage without overwhelming your budget. Remember to utilize the available resources and tools to simplify the process and ensure you’re making the best choice for your family’s health and financial future. Don’t hesitate to reach out to professionals at www.waukeshahealthinsurance.com for personalized guidance and support. Your health and financial security are worth the effort.