The Best Health Insurance Plans for Preventative Care Coverage-www.waukeshahealthinsurance.com

Table of Content

The Best Health Insurance Plans for Preventative Care Coverage

Preventative care is no longer a luxury; it’s a cornerstone of a healthy and fulfilling life. Regular check-ups, screenings, and vaccinations can detect potential health issues early, leading to better outcomes and lower long-term healthcare costs. However, the cost of these vital services can be prohibitive for many, making comprehensive health insurance coverage crucial. This article explores the best health insurance plans for preventative care coverage, helping you navigate the complexities of choosing a plan that prioritizes your well-being.

Understanding Preventative Care Coverage

The Affordable Care Act (ACA) mandates that most health insurance plans cover preventative services with no cost-sharing – meaning no deductibles, copayments, or coinsurance. This includes a wide range of services recommended by the U.S. Preventive Services Task Force (USPSTF) and the Advisory Committee on Immunization Practices (ACIP). These services are designed to prevent illness and disease before they occur, significantly improving overall health outcomes.

However, not all plans are created equal. While the ACA mandates coverage, the specific services covered and the network of providers can vary significantly between plans. Understanding these nuances is critical to choosing a plan that truly meets your needs.

Types of Health Insurance Plans and Preventative Care

Several types of health insurance plans offer preventative care coverage, each with its own strengths and weaknesses:

HMO (Health Maintenance Organization): HMO plans typically require you to choose a primary care physician (PCP) within their network. Referrals are usually needed to see specialists. While they often have lower premiums, accessing out-of-network care is generally not covered. However, preventative care is usually well-covered within the network.

PPO (Preferred Provider Organization): PPO plans offer more flexibility. You can see specialists without a referral and can often see out-of-network providers, though at a higher cost. Preventative care is generally well-covered, regardless of whether you see an in-network or out-of-network provider. However, premiums tend to be higher than HMO plans.

EPO (Exclusive Provider Organization): EPO plans are similar to HMOs in that they require you to choose a PCP within the network. However, unlike HMOs, referrals are not always required to see specialists. Out-of-network care is generally not covered. Preventative care is typically well-covered within the network.

POS (Point of Service): POS plans combine elements of HMOs and PPOs. They require a PCP, but you can see out-of-network providers for a higher cost. Preventative care is usually well-covered within the network, with some coverage for out-of-network services.

Medicare and Medicaid: These government-sponsored programs also offer extensive preventative care coverage. Medicare beneficiaries, for instance, receive annual wellness visits at no cost. Medicaid coverage varies by state, but generally includes a wide range of preventative services. For specific details on your state’s Medicaid coverage, visit your state’s health insurance marketplace.

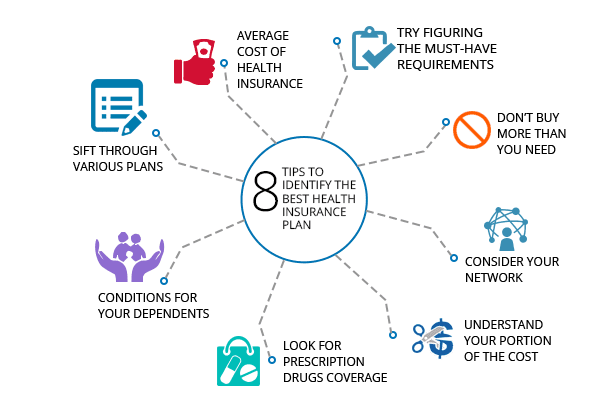

Key Factors to Consider When Choosing a Plan:

Network of Providers: Ensure the plan includes doctors and healthcare facilities you trust and are conveniently located. A comprehensive network is crucial for easy access to preventative services.

Premium Costs: Balance the cost of premiums with the plan’s coverage. A lower premium might mean higher out-of-pocket costs for services not covered or with higher cost-sharing.

Deductible and Out-of-Pocket Maximum: While preventative care is typically covered without cost-sharing, understanding your deductible and out-of-pocket maximum is crucial for planning your healthcare budget.

Cost-Sharing: Even with preventative care coverage, some plans may require copayments or coinsurance for certain services. Compare plans to find one with minimal cost-sharing for preventative care.

Specific Services Covered: While the ACA mandates coverage for many preventative services, review the plan’s specific list of covered services to ensure it aligns with your individual needs.

Finding the Right Plan for You

Navigating the world of health insurance can be daunting. Resources like the HealthCare.gov website can help you compare plans in your area and determine your eligibility for subsidies. You can also consult with a licensed insurance broker, who can provide personalized guidance based on your specific needs and budget. Remember, understanding your health insurance plan is crucial for maximizing your preventative care benefits and ensuring you receive the care you need to stay healthy.

The Importance of Preventative Care

Preventative care is an investment in your long-term health and well-being. Regular check-ups, screenings, and vaccinations can:

Detect diseases early: Early detection of conditions like cancer, heart disease, and diabetes significantly improves treatment outcomes and survival rates.

Prevent diseases: Vaccinations prevent many infectious diseases, while lifestyle counseling can help prevent chronic conditions like heart disease and type 2 diabetes.

Reduce healthcare costs: Preventative care can help avoid costly hospitalizations and treatments down the line.

Improve quality of life: By addressing health issues early, preventative care can help you maintain a higher quality of life for longer.

Utilizing Your Preventative Care Benefits

Once you have chosen a health insurance plan, it’s crucial to utilize its preventative care benefits. Schedule regular check-ups with your PCP, get recommended screenings, and stay up-to-date on your vaccinations. Don’t hesitate to ask your doctor about any preventative services you may need.

Conclusion

Choosing the right health insurance plan is a critical decision that directly impacts your access to preventative care. By understanding the different types of plans, considering key factors like network providers and cost-sharing, and utilizing available resources, you can find a plan that prioritizes your health and well-being. Don’t underestimate the power of preventative care – it’s an investment in a healthier, happier, and longer life. For residents of Waukesha County, Wisconsin, exploring local options is a great starting point. Consider checking out resources like www.waukeshahealthinsurance.com to find plans tailored to your specific needs. Remember, proactive healthcare is the best healthcare.