How Health Insurance Keeps Your Medical Expenses Low-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

Once you meet your deductible, your insurer begins to cover a larger percentage of your expenses.

These cost-sharing mechanisms ensure that you’re not solely responsible for the entire cost of your care. While you still contribute, the insurer significantly reduces your overall financial burden. Understanding your plan’s specific cost-sharing details is crucial for budgeting and managing your healthcare expenses effectively. Find a plan that suits your needs and budget by exploring options at www.waukeshahealthinsurance.com.

Negotiated Rates: Insurance companies negotiate discounted rates with healthcare providers (doctors, hospitals, etc.). These negotiated rates are typically lower than the prices charged to uninsured individuals. This means that even with cost-sharing, your expenses are often lower than they would be without insurance.

Preventive Care: Many health insurance plans cover preventive services, such as annual check-ups, vaccinations, and screenings, at little to no cost. These preventive measures can help detect health problems early, potentially preventing more expensive treatments down the line. Regular check-ups can lead to early diagnosis and treatment, saving you money in the long run.

Access to a Network of Providers: Most health insurance plans offer access to a network of healthcare providers who have agreed to provide services at discounted rates. Using in-network providers can significantly reduce your out-of-pocket expenses. Choosing an out-of-network provider may result in higher costs.

Catastrophic Protection: Health insurance offers crucial protection against catastrophic medical events, such as serious illnesses or accidents. Without insurance, the cost of these events could be financially devastating. Your health insurance policy acts as a safeguard, ensuring that you can receive necessary care without facing crippling debt.

Choosing the Right Health Insurance Plan:

Selecting the right health insurance plan is a critical decision. Factors to consider include:

- Premium Costs: The monthly payments you make for your insurance coverage.

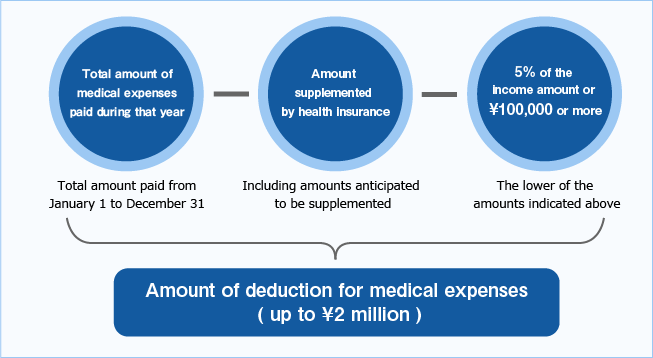

- Deductible: The amount you pay out-of-pocket before coverage begins.

- Copays and Coinsurance: Your cost-sharing responsibilities.

- Network of Providers: The doctors and hospitals covered by your plan.

- Prescription Drug Coverage: The extent to which your plan covers prescription medications.

- Mental Health and Substance Use Disorder Benefits: The coverage for mental health and addiction treatment services.

For personalized guidance on selecting the right health insurance plan in Waukesha, Wisconsin, visit www.waukeshahealthinsurance.com. Our team of experts can help you navigate the complexities of health insurance and find a plan that meets your specific needs and budget.

The Importance of Health Insurance for Long-Term Financial Security:

Health insurance is not just about covering immediate medical expenses; it’s a vital component of long-term financial security. Unexpected medical bills can significantly impact your savings, credit score, and overall financial well-being. Health insurance provides a financial safety net, allowing you to focus on your recovery rather than worrying about mounting medical debt.

Beyond Financial Benefits:

The benefits of health insurance extend beyond the financial realm. It provides access to timely and necessary medical care, improving health outcomes and overall quality of life. Early detection and treatment of health problems, facilitated by regular check-ups covered by insurance, can significantly improve long-term health and well-being.

Conclusion:

Health insurance is a crucial investment in your health and financial security. By sharing the cost of healthcare, negotiating discounted rates, and providing access to preventive care, health insurance significantly reduces the financial burden of medical expenses. Understanding your plan’s details and choosing the right coverage are essential steps in protecting yourself and your family from the potentially devastating costs of healthcare. Don’t delay; secure your financial future and your health by exploring your options today at www.waukeshahealthinsurance.com. We are here to help you find the best health insurance plan to fit your individual needs and budget. Contact us today for a free consultation. Learn more about our comprehensive plans and services at www.waukeshahealthinsurance.com. We look forward to assisting you in your journey towards better health and financial peace of mind.