Health Insurance Plans with Flexible Coverage Options-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

With a multitude of options, varying coverage levels, and confusing jargon, it’s easy to feel overwhelmed. However, understanding your needs and exploring the available options, particularly those offering flexible coverage, can significantly simplify the process and lead you to a plan that best suits your individual circumstances. This article will delve into the world of flexible health insurance plans, highlighting key features and considerations to help you make an informed decision.

Understanding the Basics of Health Insurance

Before diving into flexible options, it’s crucial to grasp the fundamental components of a health insurance plan. Most plans share common elements:

- Premium: This is the monthly payment you make to maintain your insurance coverage.

- Deductible: This is the amount you pay out-of-pocket before your insurance coverage kicks in.

- Copay: A fixed amount you pay for a doctor’s visit or other covered service.

- Coinsurance: Your share of the costs of a covered healthcare service, calculated as a percentage after you’ve met your deductible.

- Out-of-Pocket Maximum: The most you’ll pay out-of-pocket in a year for covered services. Once this limit is reached, your insurance covers 100% of the costs.

- Network: The group of doctors, hospitals, and other healthcare providers contracted with your insurance company. Using in-network providers generally results in lower costs.

The Rise of Flexible Health Insurance Plans

Traditional health insurance plans often come in a few standardized options, leaving little room for customization. However, the demand for greater flexibility and control over healthcare costs has driven the development of plans offering more tailored coverage. These plans allow individuals to select features that align with their specific healthcare needs and budget.

Types of Flexible Health Insurance Plans

Several types of plans offer varying degrees of flexibility:

High-Deductible Health Plans (HDHPs): These plans have higher deductibles but lower premiums. They’re often paired with a Health Savings Account (HSA), which allows you to save pre-tax money for healthcare expenses. Learn more about HDHPs and HSAs by exploring options from reputable providers like Waukesha Health Insurance. Visit www.waukeshahealthinsurance.com today!

Catastrophic Plans: Designed for young adults and others who are generally healthy, these plans have very high deductibles but very low premiums. They primarily cover catastrophic illnesses or injuries.

Flexible Spending Accounts (FSAs): While not a health insurance plan itself, an FSA allows you to set aside pre-tax money to pay for eligible healthcare expenses. It offers flexibility in managing healthcare costs within a specific plan.

Individual Plans: These plans are purchased directly by individuals, offering a wide range of choices in terms of coverage and premiums. For personalized guidance on choosing an individual plan, consult the experts at www.waukeshahealthinsurance.com.

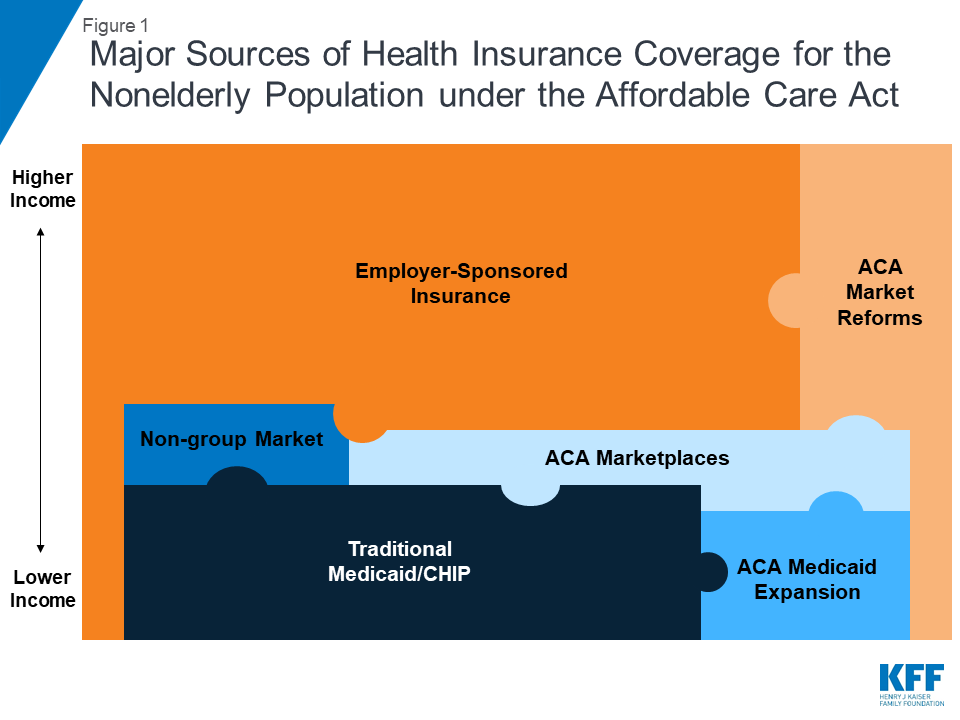

Affordable Care Act (ACA) Marketplace Plans: The ACA marketplaces offer a variety of plans with different levels of coverage, allowing you to choose a plan that best fits your budget and needs. Explore the ACA marketplace options and find a plan that works for you by visiting www.waukeshahealthinsurance.com.

Factors to Consider When Choosing a Flexible Plan

Choosing the right flexible health insurance plan requires careful consideration of several factors:

Your Health Status: If you have pre-existing conditions or anticipate significant healthcare needs, a plan with lower deductibles and copays might be preferable, even if it means higher premiums.

Your Budget: Balance the cost of premiums, deductibles, and copays against your overall financial situation. www.waukeshahealthinsurance.com can help you find plans that fit your budget.

Your Healthcare Needs: Consider your typical healthcare usage. If you rarely visit the doctor, a high-deductible plan might be suitable. However, if you anticipate frequent visits or potential major medical expenses, a plan with lower out-of-pocket costs might be more appropriate.

Your Employer’s Benefits: If your employer offers health insurance, carefully compare the options available through your workplace with individual plans. You might find that your employer’s plan offers more favorable terms.

Network of Providers: Ensure that your preferred doctors and hospitals are included in the plan’s network. Out-of-network care can significantly increase your costs.

Prescription Drug Coverage: If you take prescription medications regularly, check the plan’s formulary (list of covered medications) and associated costs.

The Importance of Professional Guidance

Navigating the complexities of health insurance can be challenging. Seeking professional guidance from an insurance broker or agent can significantly simplify the process. They can help you understand your options, compare plans, and choose the one that best aligns with your needs and budget.

For expert advice and personalized guidance on choosing the right health insurance plan in Waukesha, Wisconsin, visit www.waukeshahealthinsurance.com. Our team of experienced professionals is dedicated to helping you find the perfect coverage to protect your health and financial well-being.

Conclusion

Choosing a health insurance plan with flexible coverage options empowers you to take control of your healthcare costs and access the care you need. By carefully considering your individual circumstances, exploring the available plans, and seeking professional guidance, you can find a plan that provides the right balance of coverage, affordability, and peace of mind. Remember to thoroughly research your options and don’t hesitate to ask questions to ensure you make the best decision for your health and financial future. Start your search for the perfect plan today at www.waukeshahealthinsurance.com. They offer a wide range of plans to suit diverse needs and budgets. Don’t delay – securing the right health insurance is a crucial step towards a healthier and more secure future.