Health Insurance and Long-Term Care: What You Need to Know-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

This article aims to demystify these interconnected aspects, providing a comprehensive overview of health insurance, its limitations regarding long-term care, and the options available to protect yourself and your family from the significant financial burden it can impose. We’ll explore the different types of insurance, the costs involved, and how to make informed decisions to secure your future.

Understanding Health Insurance Fundamentals

Health insurance is a contract between you and an insurance company. In exchange for regular payments (premiums), the insurer agrees to cover a portion of your medical expenses. The specifics of coverage vary widely depending on the plan type, but generally, health insurance helps pay for:

- Doctor visits: Routine checkups, specialist consultations, and emergency room visits.

- Hospital stays: Inpatient care, surgery, and related services.

- Prescription drugs: Medications prescribed by your doctor.

- Diagnostic tests: X-rays, blood tests, and other diagnostic procedures.

- Mental health services: Therapy, counseling, and psychiatric care.

However, it’s crucial to understand that standard health insurance policies generally do not cover long-term care. This is a critical distinction that many people overlook until it’s too late. Long-term care refers to the ongoing assistance needed for individuals with chronic illnesses, disabilities, or cognitive impairments, such as Alzheimer’s disease. This care can include assistance with activities of daily living (ADLs) like bathing, dressing, and eating, as well as skilled nursing care.

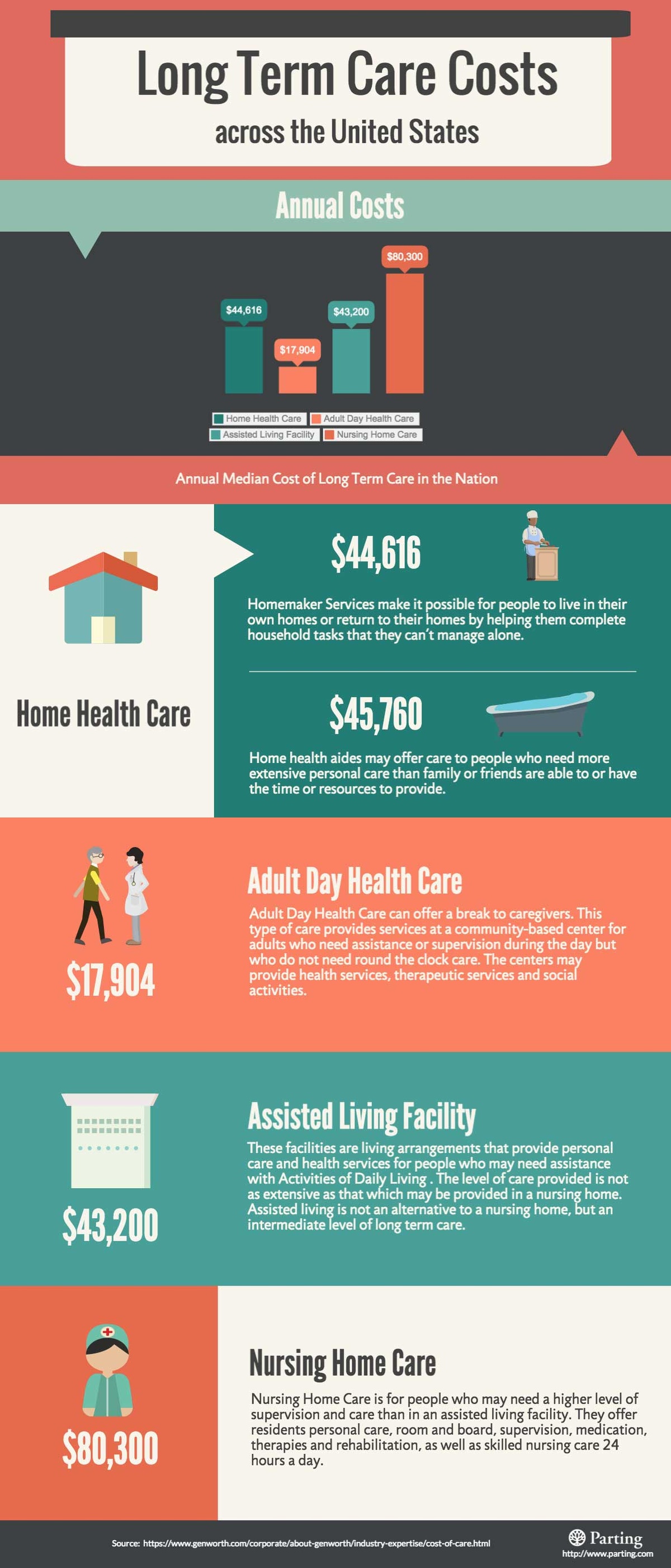

The High Cost of Long-Term Care

The cost of long-term care is substantial and can quickly deplete savings. The average annual cost of a nursing home can exceed $100,000, and home healthcare services are also expensive. The length of time someone requires long-term care can vary significantly, ranging from a few months to many years. This unpredictable nature makes it essential to plan ahead and consider the financial implications.

Why Traditional Health Insurance Falls Short for Long-Term Care

While health insurance covers acute medical needs, it’s not designed to address the ongoing, non-acute care required for chronic conditions. Most health insurance plans have limitations or exclusions that prevent coverage for:

- Custodial care: This refers to assistance with ADLs that doesn’t require skilled medical professionals. It’s the most common type of long-term care and is typically not covered by health insurance.

- Chronic conditions: While health insurance may cover treatment for specific conditions, it usually won’t cover the ongoing care needed to manage them over the long term.

- Extended stays: Health insurance often has limits on the length of hospital stays or rehabilitation services. Long-term care frequently extends far beyond these limits.

Options for Long-Term Care Coverage

Given the limitations of traditional health insurance, several options exist to address the financial risks associated with long-term care:

Long-Term Care Insurance: This specialized insurance policy is designed to cover the costs of long-term care services, including nursing home care, assisted living, and home healthcare. Learn more about long-term care insurance options by visiting our website: www.waukeshahealthinsurance.com. It’s important to purchase this type of insurance when you’re younger and healthier, as premiums increase with age and health conditions.

Medicaid: Medicaid is a government-funded program that provides healthcare coverage for low-income individuals and families. It can cover long-term care services, but eligibility requirements are strict, and it typically requires significant depletion of assets.

Medicare: Medicare, another government-funded program, primarily covers short-term rehabilitation services after a hospital stay. It has very limited coverage for long-term care.

Veterans Benefits: Veterans may be eligible for long-term care benefits through the Department of Veterans Affairs (VA), depending on their service history and health conditions.

Self-Insurance: Setting aside a significant amount of savings to self-fund long-term care is another option, but it carries significant risk, as the actual costs could easily exceed your savings.

Choosing the Right Long-Term Care Solution

Selecting the appropriate long-term care solution depends on several factors, including:

- Age and health: Younger individuals generally qualify for lower premiums on long-term care insurance.

- Financial resources: Assess your current savings and income to determine your ability to afford premiums and potential out-of-pocket expenses.

- Family history: A family history of chronic illnesses or cognitive decline can increase the likelihood of needing long-term care.

- Personal preferences: Consider your preferred care setting (nursing home, assisted living, home healthcare) and the level of care you anticipate needing.

For personalized guidance on selecting the right long-term care plan, contact our experts at www.waukeshahealthinsurance.com. We can help you navigate the complexities of insurance options and find a solution that aligns with your individual needs and budget.

The Importance of Planning Ahead

Planning for long-term care is crucial, regardless of your age or health status. The financial burden of long-term care can be devastating for individuals and families unprepared for the unexpected. By understanding the limitations of traditional health insurance and exploring the available options for long-term care coverage, you can protect your financial security and ensure you receive the care you need when you need it.

Key Considerations When Evaluating Long-Term Care Options:

- Policy benefits: Carefully review the specific services covered by each policy, including the daily benefit amount, inflation protection, and benefit period.

- Premiums: Compare premiums from different insurers to find the most affordable option that meets your needs.

- Waiting periods: Understand the waiting period before benefits begin, as this can impact coverage during a critical time.

- Exclusions: Review the policy exclusions to ensure you understand what services are not covered.

- Renewability: Check the policy’s renewability clause to determine whether the insurer can cancel or increase premiums in the future.

Don’t delay in planning for your long-term care needs. Contact us today at www.waukeshahealthinsurance.com to discuss your options and get personalized advice. We’re committed to helping you secure your future and protect your family from the financial burden of long-term care.

In Conclusion:

While health insurance is essential for covering acute medical expenses, it’s not a substitute for long-term care coverage. The high cost and unpredictable nature of long-term care necessitate proactive planning. By understanding your options and seeking professional guidance, you can make informed decisions to safeguard your financial well-being and ensure access to quality care in the future. Start planning today by visiting our website: www.waukeshahealthinsurance.com.