Tips for Finding Health Insurance That Works for Your Budget-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

The sheer volume of plans, coverage options, and jargon can feel overwhelming, leaving individuals feeling lost and frustrated. But securing adequate health coverage doesn’t have to be a stressful ordeal. With careful planning and research, you can find a health insurance plan that fits your budget and healthcare needs. This comprehensive guide will equip you with the knowledge and strategies to navigate the complexities of the health insurance market and find the perfect fit for you and your family.

Understanding Your Healthcare Needs:

Before diving into the specifics of plans and premiums, it’s crucial to understand your individual healthcare needs. Consider the following factors:

Your current health status: Do you have any pre-existing conditions? Are you currently taking prescription medications? Do you anticipate needing significant medical care in the near future? Understanding your current health situation will help you determine the level of coverage you require.

Your family’s health history: A family history of certain diseases can significantly impact your healthcare needs and the type of coverage you should seek.

Your lifestyle: Are you an active individual prone to injuries? Do you have specific dietary needs or engage in activities that increase your risk of accidents? These factors can influence your healthcare requirements.

Your anticipated healthcare utilization: Consider how often you typically visit the doctor, whether you need specialist care, and the likelihood of hospitalizations. This will help you assess the level of coverage you’ll need.

Exploring Your Options:

Once you’ve assessed your healthcare needs, you can start exploring the various health insurance options available. The primary avenues for obtaining health insurance in the US include:

Employer-sponsored plans: Many employers offer health insurance as part of their employee benefits package. These plans often provide comprehensive coverage at a relatively affordable price, with the employer contributing a significant portion of the premium. However, the specific benefits and costs will vary depending on your employer and the plan they offer.

Individual market plans: If you’re self-employed, work for a company that doesn’t offer health insurance, or are ineligible for other coverage options, you can purchase a plan through the individual market. These plans are offered through various insurance companies and can be purchased directly from the insurer or through a health insurance broker. The Affordable Care Act (ACA) marketplaces provide a platform to compare plans and enroll in coverage. Navigating this marketplace can be complex, so seeking assistance from a broker or using online comparison tools can be beneficial. For residents of Waukesha County, Wisconsin, exploring options through a local broker specializing in Waukesha health insurance can be particularly helpful. They can guide you through the available plans and help you find the best fit for your needs and budget.

Medicaid and Medicare: Medicaid provides healthcare coverage for low-income individuals and families, while Medicare is a federal health insurance program for individuals aged 65 and older or those with certain disabilities. Eligibility requirements vary, and you’ll need to apply through your state’s Medicaid or Medicare agency.

COBRA: The Consolidated Omnibus Budget Reconciliation Act (COBRA) allows you to continue your employer-sponsored health insurance coverage for a limited time after you lose your job or experience a change in employment status. However, you’ll be responsible for paying the full premium, which can be significantly higher than when your employer was contributing.

Understanding Key Terms and Concepts:

Understanding the following terms is crucial for navigating the health insurance landscape:

Premium: The monthly payment you make to maintain your health insurance coverage.

Deductible: The amount you must pay out-of-pocket for healthcare services before your insurance coverage kicks in.

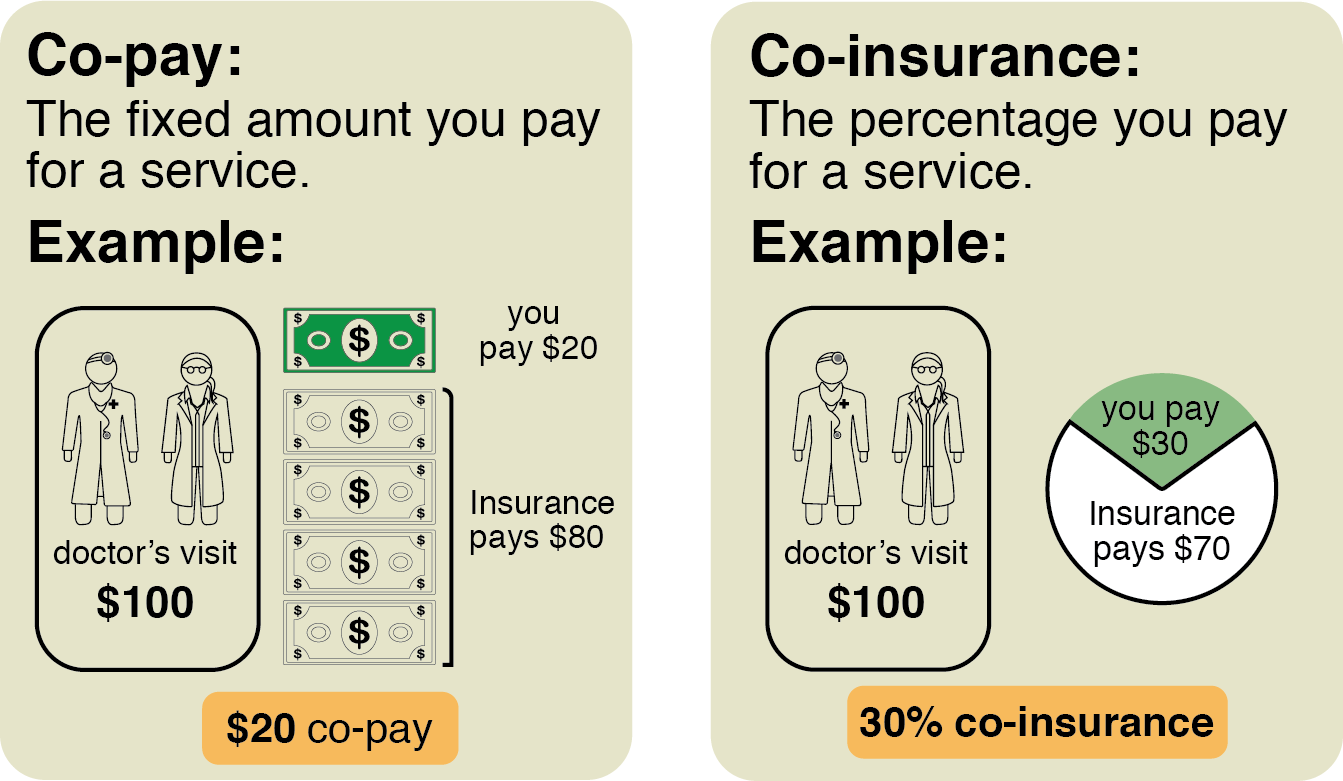

Copay: A fixed amount you pay for a covered healthcare service, such as a doctor’s visit.

Coinsurance: Your share of the costs of a covered healthcare service, calculated as a percentage of the allowed amount.

Out-of-pocket maximum: The maximum amount you’ll have to pay out-of-pocket for covered healthcare services in a plan year. Once you reach this limit, your insurance will cover 100% of the costs.

Network: The group of doctors, hospitals, and other healthcare providers that your insurance plan contracts with. Using in-network providers typically results in lower costs.

Tips for Finding Affordable Health Insurance:

Compare plans carefully: Use online comparison tools and consult with a health insurance broker to compare plans based on premiums, deductibles, copays, coinsurance, and out-of-pocket maximums. Consider the trade-offs between lower premiums and higher out-of-pocket costs.

Consider a high-deductible health plan (HDHP): HDHPs typically have lower premiums but higher deductibles. They’re a good option for healthy individuals who don’t anticipate needing frequent medical care. Often, HDHPs are paired with a Health Savings Account (HSA), which allows you to save pre-tax money for healthcare expenses.

Take advantage of subsidies and tax credits: If you qualify, you may be eligible for subsidies or tax credits to help reduce the cost of your health insurance premiums. The ACA marketplaces offer these assistance programs.

Explore options for cost-sharing reductions: These reduce your out-of-pocket costs, such as copays and coinsurance.

Negotiate with your healthcare providers: Don’t hesitate to negotiate prices with your healthcare providers, especially for services not covered by your insurance.

Utilize preventive care: Many plans cover preventive care services at no cost, so take advantage of these services to maintain your health and avoid more expensive treatments down the line.

Shop around for prescription drugs: Compare prices at different pharmacies to find the best deals on your prescription medications.

Consider a health insurance broker: A knowledgeable broker can help you navigate the complexities of the health insurance market and find a plan that meets your needs and budget. For those in Waukesha County, seeking assistance from a local expert in Waukesha health insurance can be particularly beneficial. They can provide personalized guidance and ensure you’re making informed decisions. A broker’s expertise can save you time, money, and frustration in the long run.

The Importance of Continuous Monitoring:

Finding the right health insurance is only the first step. It’s crucial to monitor your plan regularly and make adjustments as needed. Life circumstances change, and your healthcare needs may evolve over time. Review your plan annually, or even more frequently if you experience significant life changes, such as marriage, childbirth, or job loss. Staying informed about your coverage and making necessary adjustments will ensure you have the protection you need throughout your life. Don’t hesitate to reach out to your insurance provider or a health insurance broker if you have any questions or concerns. Remember, securing affordable and adequate health insurance is a crucial investment in your well-being and financial security. By following these tips and engaging in diligent research, you can navigate the health insurance market with confidence and find a plan that works perfectly for you. For residents of Waukesha County, Wisconsin, consider consulting a specialist in Waukesha health insurance to simplify the process and find the best possible coverage.