The Role of Health Insurance in Preventative Healthcare-www.waukeshahealthinsurance.com

Table of Content

The Role of Health Insurance in Preventative Healthcare

Preventative healthcare, the proactive approach to maintaining health and preventing disease, is increasingly recognized as crucial for a healthy population and a sustainable healthcare system. However, the cost of preventative services can be a significant barrier for many individuals, highlighting the critical role of health insurance in making these vital services accessible. This article will explore the multifaceted ways health insurance facilitates preventative healthcare, examining its impact on individual well-being, public health, and the overall economy.

The Financial Barrier to Preventative Care:

The upfront costs associated with preventative care, such as annual physicals, vaccinations, screenings for various diseases (cancer, diabetes, heart disease), and health education programs, can be substantial. For individuals without health insurance, these costs can be prohibitive, leading to delayed or forgone care. This delay can have serious consequences, transforming manageable conditions into severe and costly health crises requiring far more extensive and expensive treatment. Find a health insurance plan that suits your needs and budget at www.waukeshahealthinsurance.com. They offer a range of plans designed to cover preventative care.

Health Insurance as an Enabler of Access:

Health insurance acts as a crucial financial buffer, mitigating the out-of-pocket expenses associated with preventative care. Most comprehensive health insurance plans cover a wide range of preventative services with minimal or no cost-sharing, such as co-pays or deductibles. This means individuals can access essential screenings and vaccinations without worrying about crippling medical bills. This accessibility is paramount in encouraging individuals to engage in proactive health management. The peace of mind provided by knowing preventative care is financially feasible encourages regular check-ups and screenings, leading to earlier disease detection and improved health outcomes.

Specific Preventative Services Covered by Insurance:

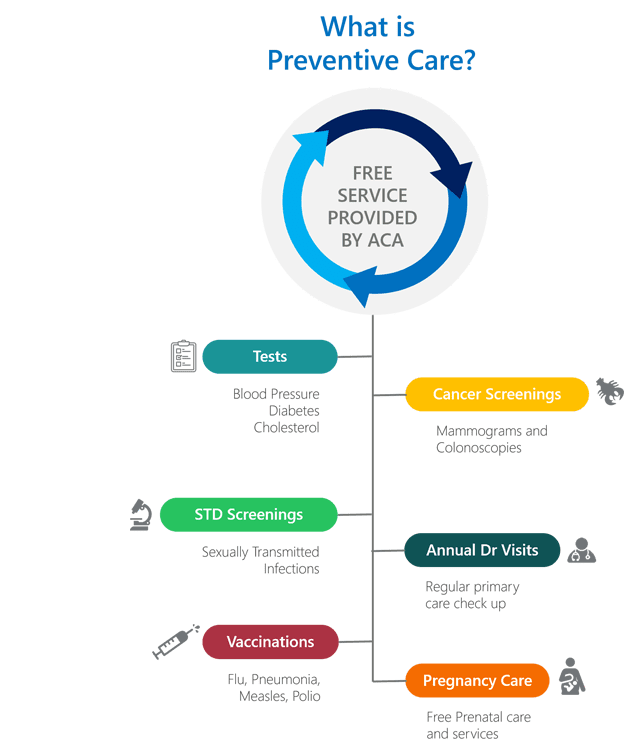

The specific preventative services covered vary depending on the type of health insurance plan and the insurer. However, many plans typically include:

- Annual Wellness Visits: These comprehensive check-ups involve physical examinations, health assessments, and personalized health advice.

- Vaccinations: Coverage for routine vaccinations against preventable diseases like influenza, pneumonia, and shingles is widely available.

- Cancer Screenings: Mammograms, Pap smears, colonoscopies, and prostate cancer screenings are frequently covered, enabling early detection and treatment of potentially life-threatening cancers.

- Chronic Disease Management: For individuals with pre-existing conditions like diabetes or hypertension, insurance often covers regular check-ups, medication management, and educational programs to help manage their conditions effectively.

- Mental Health Services: Preventative mental health services, including counseling and therapy, are increasingly covered by insurance plans, recognizing the importance of mental well-being in overall health.

- Prenatal and Postnatal Care: For pregnant women, comprehensive prenatal and postnatal care is crucial for both maternal and infant health. Health insurance plays a vital role in ensuring access to these services.

The Public Health Impact of Insured Preventative Care:

The impact of health insurance on preventative care extends beyond individual benefits, significantly influencing public health outcomes. Increased access to preventative services leads to:

- Early Disease Detection: Early detection of diseases through screenings allows for timely intervention, improving treatment outcomes and reducing mortality rates.

- Reduced Disease Prevalence: By preventing diseases from developing or progressing, preventative care contributes to a reduction in the overall prevalence of chronic diseases, lessening the burden on the healthcare system.

- Improved Population Health: Widespread access to preventative care leads to a healthier population, increasing productivity, and improving the overall quality of life.

- Reduced Healthcare Costs: While preventative care involves upfront costs, it ultimately leads to significant cost savings in the long run by preventing the need for more expensive treatments for advanced diseases. Investing in preventative care is an investment in a healthier and more cost-effective healthcare system.

The Economic Benefits of Preventative Care:

The economic benefits of preventative care facilitated by health insurance are substantial. These include:

- Increased Productivity: A healthy workforce is a productive workforce. Preventative care contributes to a healthier and more productive population, boosting economic growth.

- Reduced Healthcare Expenditures: As mentioned earlier, preventing diseases is far more cost-effective than treating them. Health insurance coverage for preventative care contributes to a reduction in overall healthcare costs.

- Improved Quality of Life: Preventative care improves the quality of life for individuals, allowing them to live longer, healthier, and more fulfilling lives. This translates to increased societal well-being and economic stability.

Choosing the Right Health Insurance Plan:

Navigating the complexities of health insurance can be challenging. It’s crucial to understand the coverage offered by different plans, including the extent of preventative care coverage. Visit www.waukeshahealthinsurance.com to explore various plans and find one that best meets your needs and budget. Consider factors such as premium costs, deductibles, co-pays, and the specific preventative services included in the plan. Don’t hesitate to contact an insurance professional for guidance.

Conclusion:

Health insurance plays a pivotal role in making preventative healthcare accessible and affordable. By removing financial barriers, it empowers individuals to take proactive steps towards maintaining their health and preventing diseases. The positive impact extends far beyond the individual level, contributing to improved public health outcomes, reduced healthcare costs, and enhanced economic productivity. Investing in health insurance that prioritizes preventative care is an investment in a healthier future for individuals, communities, and the nation as a whole. For comprehensive health insurance options in Waukesha, Wisconsin, explore the plans available at www.waukeshahealthinsurance.com. They are dedicated to helping you find the right coverage to support your preventative healthcare needs. Remember, proactive healthcare is not just about avoiding illness; it’s about living a longer, healthier, and more fulfilling life.