How Health Insurance Can Save You Money in the Long Run-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

Many plans cover routine checkups, screenings, and vaccinations at little to no cost. These preventive measures can detect potential health problems early, allowing for timely intervention and preventing more serious, and expensive, conditions from developing. Early detection of diseases like cancer, heart disease, or diabetes can significantly reduce the long-term cost of treatment. Regular checkups also help maintain overall health, reducing the likelihood of needing costly emergency care.

Reduced Out-of-Pocket Expenses:

Health insurance significantly reduces your out-of-pocket expenses for medical care. While you will still have to pay premiums, deductibles, and co-pays, these costs are typically far less than the total cost of medical services without insurance. www.waukeshahealthinsurance.com can help you understand the various plan options and their associated costs, allowing you to choose a plan that best suits your budget and healthcare needs. The cost-sharing mechanisms built into most plans – deductibles, co-pays, and coinsurance – help manage the overall expense, preventing you from shouldering the entire burden of medical bills.

Negotiated Rates and Discounts:

Insurance companies negotiate lower rates with healthcare providers, resulting in significant savings for policyholders. These negotiated rates are typically much lower than what uninsured individuals would pay for the same services. This means that even with co-pays and deductibles, the overall cost of care is significantly reduced compared to paying full price for medical services. The network of providers associated with your insurance plan plays a crucial role in accessing these negotiated rates.

Prescription Drug Coverage:

Prescription drugs can be incredibly expensive, especially for those with chronic conditions requiring ongoing medication. Health insurance plans typically include prescription drug coverage, reducing the cost of essential medications. This coverage can be particularly beneficial for individuals with chronic illnesses like diabetes, hypertension, or asthma, ensuring access to life-sustaining medications without incurring exorbitant costs. Understanding your prescription drug coverage is crucial, and www.waukeshahealthinsurance.com can provide valuable information on available plans and their formularies.

Mental Health and Substance Abuse Coverage:

The importance of mental health and substance abuse treatment is increasingly recognized. Many health insurance plans now include comprehensive coverage for these services, making them more accessible and affordable. Without insurance, the cost of therapy, counseling, and rehabilitation can be prohibitive, potentially delaying or preventing much-needed treatment. Access to affordable mental health and substance abuse services can lead to significant long-term cost savings by preventing more severe issues and improving overall well-being.

Protecting Your Assets:

Beyond the direct cost savings, health insurance protects your assets. Without insurance, a major illness or accident could wipe out your savings and leave you with significant debt. Health insurance acts as a financial safety net, preventing catastrophic medical expenses from jeopardizing your financial stability. This protection extends to your home, car, and other assets, safeguarding your future financial security.

Long-Term Care Coverage:

As we age, the need for long-term care increases. Long-term care insurance, often available as a rider or separate policy, can help cover the costs of nursing homes, assisted living facilities, and in-home care. These costs can be extremely high, and long-term care insurance can provide crucial financial protection, preventing you from depleting your savings or relying on family members for support.

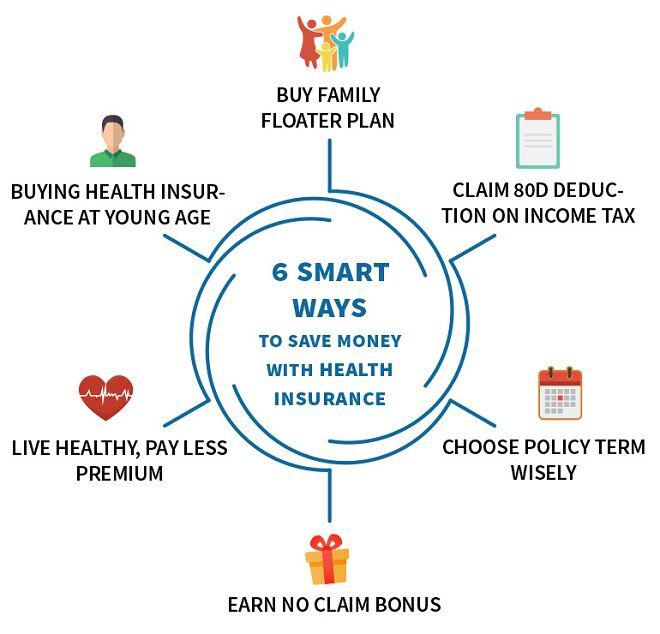

Choosing the Right Plan:

Selecting the right health insurance plan is crucial to maximizing its financial benefits. Factors such as your health status, budget, and healthcare needs should be considered when choosing a plan. www.waukeshahealthinsurance.com offers resources to help you understand the different types of plans, including HMOs, PPOs, and EPOs, and their respective cost-sharing mechanisms. Understanding the details of your plan, including deductibles, co-pays, and out-of-pocket maximums, is essential to making informed decisions about your healthcare.

The Value of Peace of Mind:

Beyond the financial benefits, health insurance provides invaluable peace of mind. Knowing that you have protection against unexpected medical expenses allows you to focus on your health and well-being without the constant worry of crippling medical debt. This peace of mind is an invaluable asset, contributing to overall happiness and reducing stress.

Conclusion:

While the monthly premiums for health insurance represent an ongoing expense, the long-term financial benefits are undeniable. Health insurance protects against catastrophic medical costs, provides access to preventive care, reduces out-of-pocket expenses, and offers peace of mind. By understanding the various ways health insurance can save you money and choosing the right plan, you can safeguard your financial future and ensure access to quality healthcare. For residents of Waukesha, Wisconsin, exploring the options at www.waukeshahealthinsurance.com is a crucial first step in securing your financial well-being and access to comprehensive healthcare. Don’t let the fear of unexpected medical bills dictate your financial future; invest in your health and your financial security with health insurance.