Here’s a 1500-word article about how health insurance can save you money in the long run, incorporating the requested link and underlined keywords:-www.waukeshahealthinsurance.com

Table of Content

Here’s a 1500-word article about how health insurance can save you money in the long run, incorporating the requested link and underlined keywords:

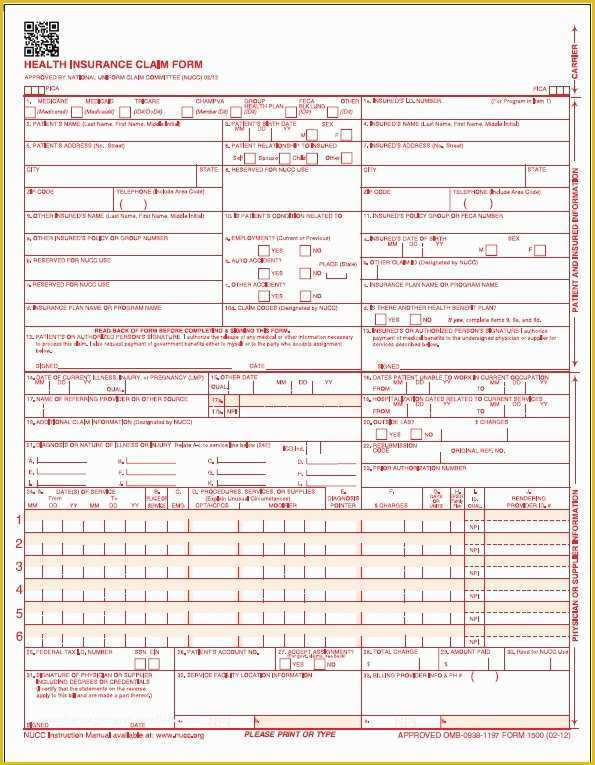

:max_bytes(150000):strip_icc()/CMS-1500-claim-form-57a2d3a85f9b589aa99caf8b.jpg)

How Health Insurance Can Save You Money in the Long Run

The cost of healthcare in the United States is notoriously high. A single unexpected illness or injury can easily lead to tens of thousands of dollars in medical bills, potentially crippling your finances. While the monthly premiums for health insurance might seem like an added expense, the long-term financial benefits far outweigh the costs for the vast majority of individuals and families. Investing in health insurance is not just about protecting your health; it’s a smart financial strategy that can save you significant money over time.

This article will explore the various ways health insurance can protect your financial well-being, offering a comprehensive look at its long-term cost-saving potential. We’ll delve into the different types of coverage, the hidden costs of going without insurance, and how to choose a plan that best suits your needs and budget. For residents of Waukesha County, Wisconsin, consider exploring the comprehensive health insurance options available at www.waukeshahealthinsurance.com.

The High Cost of Uninsured Healthcare:

Imagine facing a serious medical emergency without health insurance. The bills can be staggering. A simple hospital stay, a major surgery, or even a prolonged illness can quickly accumulate debts that take years, if not decades, to repay. This debt can impact credit scores, making it harder to secure loans, rent an apartment, or even buy a car. Beyond the direct medical costs, there are also indirect costs to consider:

- Lost Wages: Illness and injury often mean time off work, leading to lost income. Without insurance, you’re responsible for covering these lost wages in addition to your medical bills.

- Debt Collection: Medical debt is a significant driver of bankruptcy in the US. Dealing with debt collectors and the legal ramifications can be stressful and time-consuming.

- Limited Access to Care: Without insurance, you may delay or forgo necessary medical care due to the cost, leading to potentially more serious health problems down the line, resulting in even higher costs later. Preventive care, crucial for early detection and treatment of diseases, becomes a luxury rather than a necessity.

- Financial Instability: The sheer weight of unexpected medical expenses can destabilize your entire financial life, potentially impacting your savings, retirement plans, and overall financial security.

How Health Insurance Mitigates These Risks:

Health insurance acts as a financial safety net, significantly reducing the impact of unexpected medical expenses. It does this in several ways:

- Cost Sharing: Most health insurance plans involve cost-sharing mechanisms like deductibles, co-pays, and coinsurance. While you’ll still pay some out-of-pocket expenses, these are significantly less than the full cost of care. The insurance company covers the majority of the expenses, protecting you from catastrophic financial losses.

- Preventive Care: Many plans cover preventive services like annual check-ups, vaccinations, and screenings at little to no cost. Early detection and prevention are crucial for managing health conditions and avoiding costly treatments later. This proactive approach is a major cost-saver in the long run.

- Negotiated Rates: Insurance companies negotiate lower rates with healthcare providers, meaning you receive services at a discounted price compared to paying out-of-pocket.

- Prescription Drug Coverage: Many plans include prescription drug coverage, reducing the cost of essential medications. The cost of prescription drugs can be exorbitant, and insurance significantly lowers this burden.

- Mental Health Coverage: Access to mental health services is increasingly important. Many health insurance plans now offer comprehensive coverage for mental health treatment, including therapy and medication. This is crucial for overall well-being and can prevent more serious issues later on.

- Emergency Room Coverage: Emergency room visits are expensive, even for relatively minor issues. Health insurance provides coverage for emergency care, ensuring you receive necessary treatment without facing crippling financial consequences.

Choosing the Right Health Insurance Plan:

Selecting the right health insurance plan is crucial to maximizing its cost-saving benefits. Factors to consider include:

- Premium Costs: The monthly cost of your plan.

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in.

- Co-pay: The fixed amount you pay for each doctor’s visit or prescription.

- Coinsurance: The percentage of costs you pay after meeting your deductible.

- Out-of-Pocket Maximum: The maximum amount you’ll pay out-of-pocket in a year.

- Network of Providers: The doctors and hospitals covered by your plan. www.waukeshahealthinsurance.com can help you find plans with providers in your area.

It’s essential to carefully compare different plans and choose one that aligns with your health needs, budget, and preferred healthcare providers. Consider using online comparison tools or consulting with an insurance broker to make an informed decision.

The Long-Term Financial Benefits:

The long-term financial benefits of health insurance are undeniable. While the monthly premiums represent an ongoing expense, they are a small price to pay compared to the potential costs of catastrophic illness or injury without coverage. The peace of mind that comes with knowing you’re protected from financial ruin is invaluable. By preventing financial devastation from unexpected medical expenses, health insurance allows you to focus on your recovery and well-being, rather than worrying about mounting bills.

For individuals in Waukesha County, Wisconsin, seeking comprehensive and affordable health insurance options, www.waukeshahealthinsurance.com provides a valuable resource for exploring available plans and finding the best fit for your individual needs. They can assist you in navigating the complexities of health insurance and finding a plan that offers both comprehensive coverage and financial security.

Conclusion:

Investing in health insurance is a smart financial decision that protects your financial future. While the monthly premiums represent a cost, the potential savings from avoiding catastrophic medical expenses far outweigh this cost. By mitigating the risks associated with unexpected illness or injury, health insurance provides financial stability, peace of mind, and the ability to focus on your health and well-being. Don’t underestimate the importance of health insurance as a crucial component of your overall financial plan. Explore your options today and secure your financial future. For those in Waukesha, Wisconsin, start your search for the right plan at www.waukeshahealthinsurance.com.