A Quick Guide to Health Insurance Terms You Should Know-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

waukeshahealthinsurance.com.

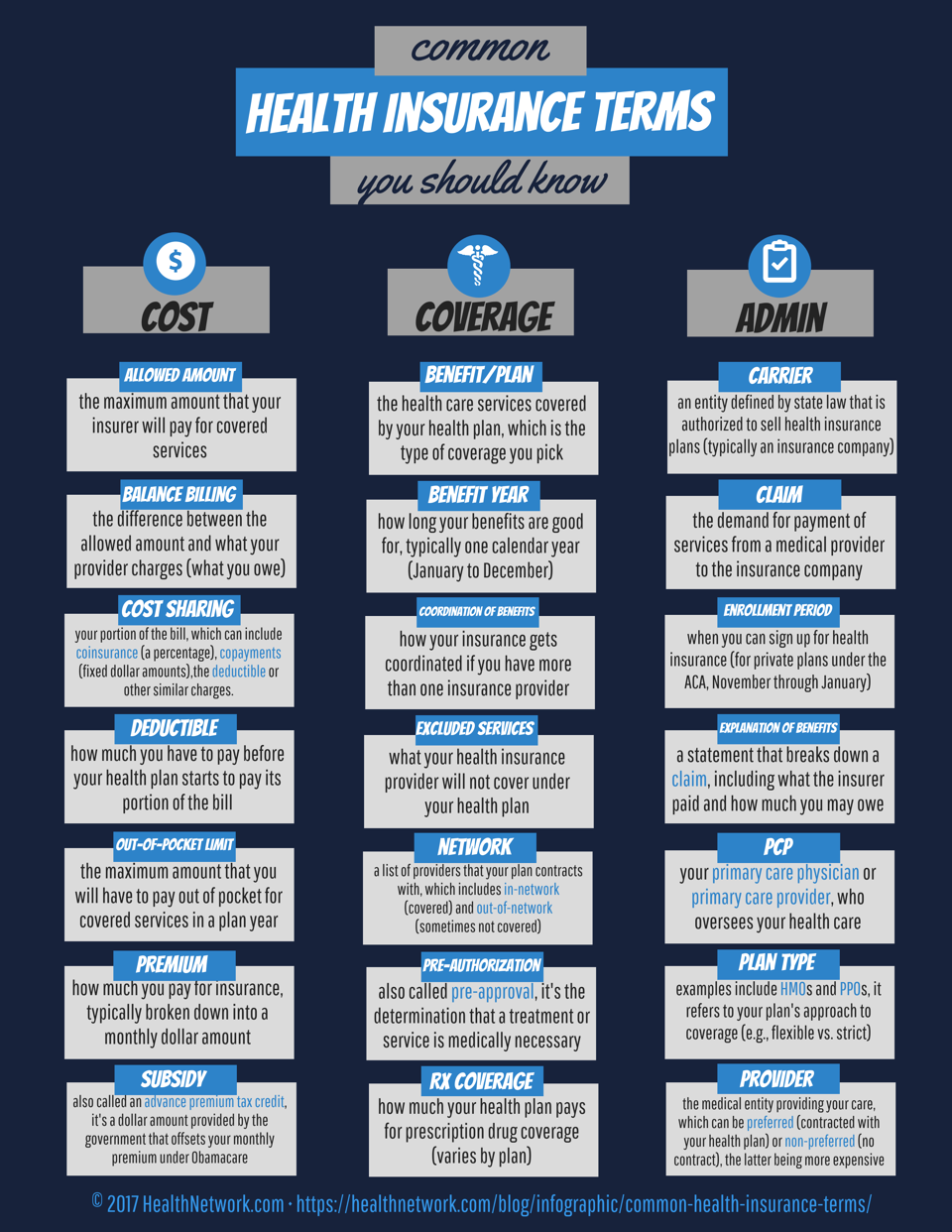

Deductible: This is the amount of money you must pay out-of-pocket for covered healthcare services before your insurance company starts to pay. For example, a $5,000 deductible means you’ll pay the first $5,000 of your medical expenses before your insurance kicks in. High-deductible plans typically have lower premiums, while low-deductible plans have higher premiums. Understanding your deductible is crucial for budgeting your healthcare expenses. www.waukeshahealthinsurance.com can help you find a plan with a deductible that fits your budget.

Copay: This is a fixed amount you pay for a covered healthcare service, such as a doctor’s visit. Copays are typically less than the full cost of the service and are due at the time of service. The amount of your copay will vary depending on your plan and the type of service. For a detailed breakdown of copays and other cost-sharing mechanisms, visit www.waukeshahealthinsurance.com.

Coinsurance: This is the percentage of the costs of a covered healthcare service that you are responsible for after you’ve met your deductible. For example, if your coinsurance is 20%, you’ll pay 20% of the bill after meeting your deductible, and your insurance company will pay the remaining 80%. Understanding your coinsurance is essential for predicting your out-of-pocket healthcare expenses. We can help you navigate the complexities of coinsurance; visit www.waukeshahealthinsurance.com.

Out-of-Pocket Maximum: This is the most you will pay out-of-pocket for covered healthcare services in a plan year. Once you reach your out-of-pocket maximum, your insurance company will pay 100% of the costs of covered services for the remainder of the year. This provides a crucial safety net against unexpectedly high medical bills. Learn more about out-of-pocket maximums and how they can protect you from financial hardship at www.waukeshahealthinsurance.com.

Network: This refers to the group of doctors, hospitals, and other healthcare providers that your insurance company has contracted with to provide services at a negotiated rate. Using in-network providers generally results in lower costs than using out-of-network providers. Choosing a plan with a network that includes your preferred doctors and hospitals is vital. www.waukeshahealthinsurance.com can help you find a plan with a network that meets your needs.

Formulary: This is a list of prescription drugs covered by your insurance plan. Your plan may have different tiers of coverage for different drugs, with some drugs costing more than others. Understanding your formulary is essential if you take prescription medications regularly. For assistance understanding your formulary and finding affordable prescription options, please visit www.waukeshahealthinsurance.com.

Explanation of Benefits (EOB): This is a statement from your insurance company that explains the payments made for your healthcare services. The EOB details the services provided, the charges, the amounts paid by your insurance, and your responsibility. Carefully reviewing your EOBs is crucial for ensuring accurate billing and identifying any potential errors.

Types of Health Insurance Plans:

Health Maintenance Organization (HMO): HMO plans typically require you to choose a primary care physician (PCP) who acts as a gatekeeper to specialists. You generally need a referral from your PCP to see specialists. HMO plans usually have lower premiums but more limited choices of providers.

Preferred Provider Organization (PPO): PPO plans offer more flexibility than HMOs. You don’t typically need a referral to see specialists, and you can see out-of-network providers, although it will usually cost more. PPO plans generally have higher premiums than HMOs.

Point of Service (POS): POS plans combine features of both HMOs and PPOs. They usually require a PCP, but you may have the option to see out-of-network providers for a higher cost.

Exclusive Provider Organization (EPO): EPO plans are similar to HMOs, but they usually offer a wider network of providers. You typically need a referral to see specialists.

High Deductible Health Plan (HDHP): HDHPs have high deductibles but lower premiums. They are often paired with a Health Savings Account (HSA), which allows you to save pre-tax money to pay for healthcare expenses.

Additional Important Considerations:

Pre-existing Conditions: The Affordable Care Act (ACA) prohibits health insurance companies from denying coverage or charging higher premiums based on pre-existing conditions.

Open Enrollment: This is the period during which you can enroll in or change your health insurance plan. Missing the open enrollment period can result in penalties or limited options. Check www.waukeshahealthinsurance.com for details on open enrollment periods.

Health Savings Account (HSA): HSAs are tax-advantaged savings accounts that can be used to pay for qualified medical expenses. They are often paired with high-deductible health plans.

Flexible Spending Account (FSA): FSAs are employer-sponsored accounts that allow you to set aside pre-tax money to pay for qualified medical expenses. The money in an FSA must typically be used within a year.

This guide provides a basic overview of common health insurance terms. The specifics of your plan will vary, so it’s essential to carefully review your policy documents and seek clarification from your insurance provider when needed. For personalized assistance in navigating the complexities of health insurance and finding a plan that meets your individual needs, contact us at www.waukeshahealthinsurance.com. We are committed to helping you understand your options and make informed decisions about your healthcare coverage. Remember, choosing the right health insurance plan is a crucial step in protecting your health and your financial well-being. Don’t hesitate to reach out to us with any questions you may have. We’re here to help.