How to Choose Health Insurance Plans During Open Enrollment-www.waukeshahealthinsurance.com-www.waukeshahealthinsurance.com

It’s a time filled with choices, jargon, and potentially overwhelming decisions. Finding the right plan can feel like navigating a maze, but with careful planning and understanding, you can find a policy that meets your needs and budget. This guide will walk you through the essential steps to make informed decisions during open enrollment, helping you select the best health insurance plan for you and your family.

Understanding the Basics: Key Terms and Concepts

Before diving into the selection process, let’s clarify some fundamental terms:

- Premium: This is your monthly payment for health insurance coverage. Lower premiums often mean higher out-of-pocket costs later.

- Deductible: The amount you pay out-of-pocket for covered healthcare services before your insurance begins to pay. A higher deductible typically means a lower premium.

- Copay: A fixed amount you pay for a covered healthcare service, such as a doctor’s visit.

- Coinsurance: Your share of the costs of a covered healthcare service, calculated as a percentage (e.g., 20%) after you’ve met your deductible.

- Out-of-Pocket Maximum: The most you’ll pay out-of-pocket in a year for covered services. Once you reach this limit, your insurance company covers 100% of the costs.

- Network: The group of doctors, hospitals, and other healthcare providers your insurance plan covers. Using in-network providers generally results in lower costs.

- HSA (Health Savings Account): A tax-advantaged savings account used to pay for qualified medical expenses. HSAs are often paired with high-deductible health plans (HDHPs).

- FSA (Flexible Spending Account): A pre-tax account used to pay for eligible medical expenses. Funds typically must be used within a year.

Step 1: Assess Your Healthcare Needs

Before you even begin browsing plans, take time to honestly assess your healthcare needs. Consider the following:

- Your health history: Do you have any pre-existing conditions? Are you generally healthy, or do you anticipate needing frequent medical care?

- Your family’s health history: Are there any family members with chronic illnesses?

- Your prescription medications: Do you take any prescription drugs regularly? Check if the plans cover your medications.

- Your preferred doctors and hospitals: Ensure your preferred providers are in the plan’s network. You can use online tools to verify this. If you need specialized care, confirm the plan covers specialists in your area.

Step 2: Understand Your Options: Plan Types

Several types of health insurance plans are available, each with its own cost-sharing structure:

- HMO (Health Maintenance Organization): Typically requires you to choose a primary care physician (PCP) who coordinates your care. You generally need referrals to see specialists. Usually, the lowest premiums but limited choices of doctors and hospitals.

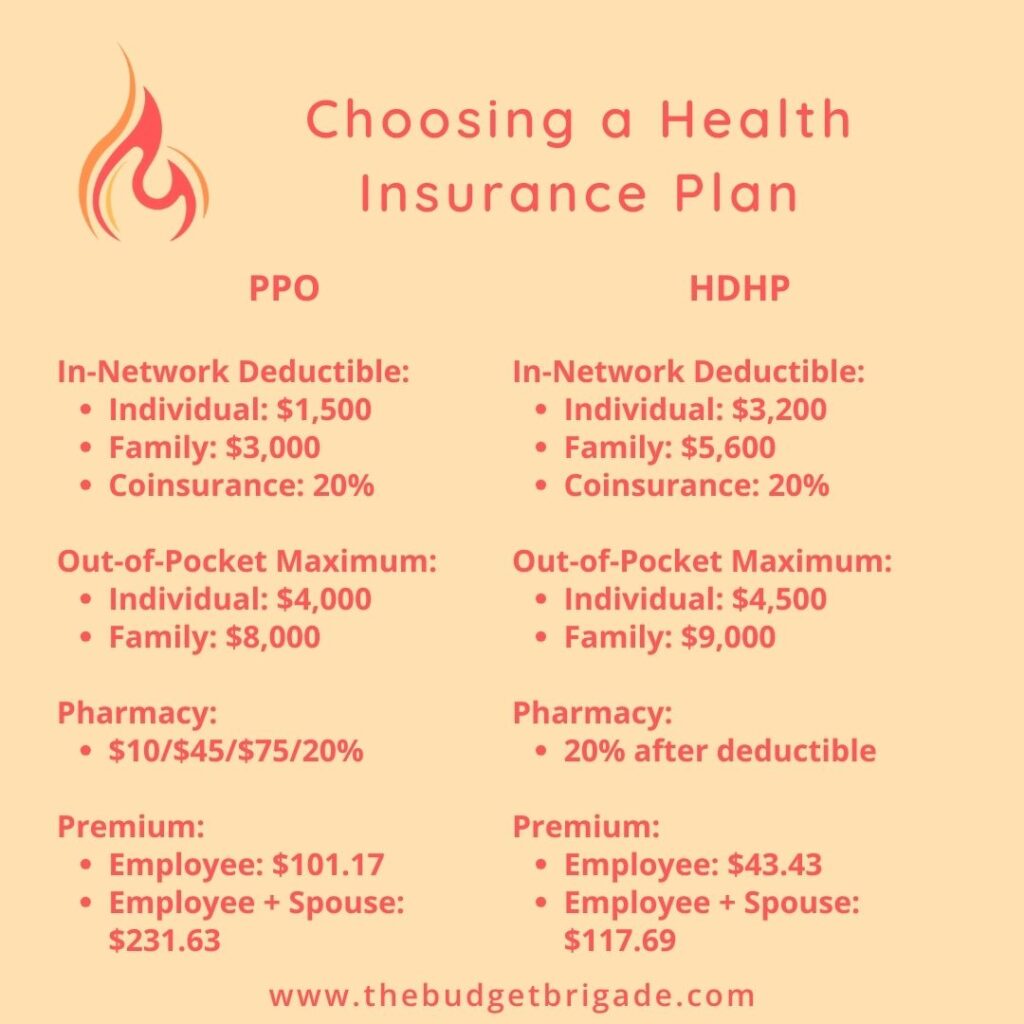

- PPO (Preferred Provider Organization): Offers more flexibility. You can see specialists without a referral, and you can see out-of-network providers, although it will cost more. Premiums are generally higher than HMOs.

- EPO (Exclusive Provider Organization): Similar to an HMO, but you typically don’t need a referral to see specialists, as long as they are in-network.

- HDHP (High-Deductible Health Plan): Offers lower premiums but higher deductibles. Often paired with an HSA. Ideal for healthy individuals who can afford to save for potential medical expenses.

- Catastrophic Plans: High deductibles and only cover essential health benefits. Generally, only available to those under 30 or those who qualify for a hardship exemption.

Step 3: Explore Available Plans and Compare

Once you’ve assessed your needs and understand the plan types, it’s time to explore the plans available in your area. Your state’s health insurance marketplace (like Healthcare.gov) is an excellent resource. You can also contact a licensed insurance broker or consult your employer’s benefits information if you’re getting coverage through your workplace. Remember to use comparison tools to see the plans side-by-side. Many online resources, including those offered by reputable insurance providers like www.waukeshahealthinsurance.com, can help simplify this process.

Step 4: Consider Your Budget

Healthcare costs can be significant. Carefully consider your budget and how much you can comfortably afford to pay in premiums, deductibles, copays, and coinsurance. Remember to factor in potential out-of-pocket expenses for prescription drugs and other healthcare services.

Step 5: Don’t Forget the Fine Print

Before making your final decision, thoroughly review the plan’s details, including the Summary of Benefits and Coverage (SBC). Pay close attention to:

- Covered services: Ensure the plan covers the services you’re likely to need.

- Network providers: Verify your doctors and hospitals are in-network.

- Prescription drug coverage: Check the formulary (list of covered drugs) to ensure your medications are covered.

- Mental health and substance use disorder benefits: Many plans now offer comprehensive coverage for these services.

- Appeals process: Understand how to appeal a claim denial.

Step 6: Utilize Available Resources

Don’t hesitate to utilize the resources available to you. Many organizations offer assistance in navigating the health insurance selection process. These include:

- Your employer’s benefits department: If your employer offers health insurance, their benefits department can answer your questions and provide guidance.

- Your state’s health insurance marketplace: These marketplaces offer tools and resources to help you compare plans.

- Licensed insurance brokers: These professionals can help you navigate the complexities of health insurance and find a plan that meets your needs.

- Healthcare.gov: The federal health insurance marketplace provides information and tools to help you find coverage.

- Local insurance providers, such as those found at www.waukeshahealthinsurance.com, often offer personalized assistance and guidance.

Step 7: Enroll and Review Annually

Once you’ve chosen a plan, enroll during the open enrollment period. Remember that your needs and circumstances can change, so it’s crucial to review your health insurance plan annually during open enrollment to ensure it continues to meet your needs.

Choosing the right health insurance plan is a significant decision. By following these steps and utilizing the available resources, you can confidently navigate the open enrollment process and find a plan that provides the coverage you need at a price you can afford. Remember to take your time, ask questions, and don’t be afraid to seek assistance from professionals. Your health and financial well-being depend on it. For additional support and resources in the Waukesha area, visit www.waukeshahealthinsurance.com.